Weekly Stock Ideas: Three Consumer Staples Stocks to Shop for Your Portfolio

This week, we use AAII’s A+ Investor Stock Grades to provide insight into three consumer staples distribution and retail stocks. With shopping for goods and groceries increasing, should you consider the three consumer staples stocks of United Natural Foods Inc. (UNFI), US Foods Holding Corp. (USFD) and Walgreens Boots Alliance Inc. (WBA)?

Consumer Staples Stocks Recent News

The global consumer staples distribution and retail industry remains resilient amid economic uncertainty, driven by the essential nature of its product offerings. Demand for everyday goods such as food, beverage, hygiene and household products has remained stable, even in inflationary environments. Consumers are increasingly seeking value-oriented options, prompting retailers to expand private label lines and enhance promotional strategies. Meanwhile, digital transformation continues to reshape the sector, with omnichannel models, e-commerce platforms and last-mile delivery playing critical roles in improving convenience and customer loyalty.

Sustainability and operational efficiency are also top priorities, with retailers investing in supply chain digitization, energy-efficient infrastructure and waste reduction initiatives to meet regulatory standards and consumer expectations. According to a report from the Food Industry Association, omnichannel grocery sales alone are projected to grow to $388 billion by 2027, as hybrid shopping habits become the norm. Grand View Research estimates that the global food and grocery retail market will reach a valuation of over $14 trillion by 2030, expanding at a compound annual growth rate (CAGR) of 3.2% from 2024 to 2030, driven by urbanization, rising middle-class income, and technological innovation in logistics and fulfillment. Given these trends, the industry may be well-positioned for steady, long-term growth.

Sign Up to Receive a Free Special Report That Shows How A+ Investor Grades Can Help You Make Investment Decisions

Grading Consumer Staples Stocks With AAII’s A+ Stock Grades

When analyzing a company, it is helpful to have an objective framework that allows you to compare companies in the same way. This is why AAII created the A+ Stock Grades, which evaluate companies across five factors that research and real-world investment results indicate to identify market-beating stocks in the long run: value, growth, momentum, earnings estimate revisions (and surprises) and quality.

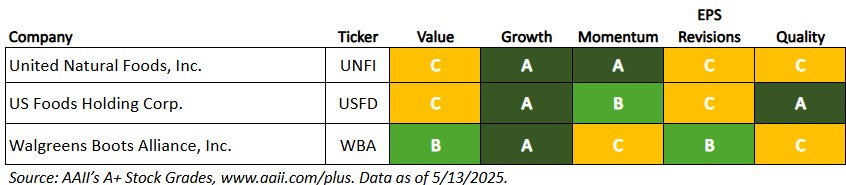

Using AAII’s A+ Stock Grades, the following table summarizes the attractiveness of three consumer staples stocks— United Natural Foods, US Foods Holding and Walgreens—based on their fundamentals.

AAII’s A+ Stock Grade Summary for Three Consumer Staples Stocks

What the A+ Stock Grades Reveal

United Natural Foods Inc. (UNFI) is a leading distributor of natural, organic, specialty and conventional grocery products in the U.S. and Canada. Headquartered in Providence, Rhode Island, the company operates an extensive network of distribution centers and services a wide range of retail formats including independent grocers, national chains and e-commerce platforms. United Natural Foods’ product portfolio spans grocery, fresh produce, perishables, wellness items and household goods, catering to both mainstream and health-conscious consumers. The company emphasizes supply chain integration and efficiency through its nationwide logistics infrastructure, technology-enabled inventory management and strategic sourcing capabilities. United Natural Foods also advances environmental and social goals through initiatives focused on reducing food waste, transitioning to renewable energy, and supporting local communities and diverse suppliers across its value chain.

United Natural Foods has a Momentum Grade of A, based on its Momentum Score of 94. This means that the stock’s momentum is very strong in terms of its weighted relative price strength over the last four quarters. The weighted four-quarter relative strength rank is the relative price change for each of the past four quarters, with the most recent quarterly price change given a weight of 40% and each of the three previous quarters given a weight of 20%. The ranks are 37, 94, 96 and 91, sequentially from the most recent quarter. The weighted four-quarter relative price strength is 21.1%.

A higher-quality stock possesses traits associated with upside potential and reduced downside risk. Backtesting of the Quality Grade shows that stocks with higher grades, on average, outperformed stocks with lower grades from 1998 through 2019.

The A+ Quality Grade is the percentile rank of the average of the percentile ranks of return on assets (ROA), return on invested capital (ROIC), gross profit to assets, buyback yield, change in total liabilities to assets, accruals to assets, Z double prime bankruptcy risk (Z) score and F-Score. To be assigned a Quality Score stocks must have a valid (non-null) measure and corresponding ranking for at least four of the eight quality measures.

United Natural Foods has a Quality Grade of C, based on a score of 53, which is average. Its gross income to assets is 54.9%, which ranks in the 91st percentile among all U.S.-listed stocks and is above the sector median of 29.8%. Its accruals to assets of –7.0% ranks in the 63rd percentile, and its Z-Score of 5.08 ranks in the 53rd percentile.

The components of the Growth Composite Score consider a company’s success in growing sales on a year-over-year and long-term annualized basis and its ability to consistently generate positive cash from its core operations. The company’s Growth Grade is A, which is very strong. United Natural Foods has generated positive annual cash from operations in the past five consecutive years and has a five-year annualized sales growth rate of 6.8%.

US Foods Holding Corp. (USFD) is one of the largest food service distributors in the U.S., supplying a broad range of food and non-food products to over 300,000 customers across sectors including restaurants, health care, education and government. Headquartered in Rosemont, Illinois, the company operates a national network of more than 70 distribution centers and a fleet of over 6,500 trucks. US Foods Holding’s product portfolio includes fresh and frozen meats, seafood, dairy, produce, bakery goods, and kitchen supplies, with a focus on delivering both branded and private-label options. The company invests heavily in digital innovation and supply chain optimization through platforms that support real-time inventory, order and menu management for customers. US Foods Holding is also committed to sustainability and responsible sourcing through its Serve Good program, which highlights products with verified environmental or social benefits, and initiatives aimed at reducing greenhouse gas emissions, food waste and packaging waste throughout its operations.

The company has a Value Grade of C, based on its Value Score of 49, which is average. The Value Grade is the percentile rank of the average of the percentile ranks of the price-to-sales (P/S) ratio, price-earnings (P/E) ratio, price-to-book-value (P/B) ratio, price-to-free-cash-flow (P/FCF) ratio, shareholder yield and the ratio of enterprise value to earnings before interest, taxes, depreciation and amortization (EBITDA).

The company has a shareholder yield of 5.7%, which ranks in the 14th percentile among all U.S.-listed stocks. Its price-to-sales ratio of 0.46 ranks in the 18th percentile. However, its price-earnings ratio is 33.8, ranking in the 76th percentile, and its price-to-book ratio is 3.77, ranking in the 76th percentile.

Earnings estimate revisions indicate how analysts view a firm’s short-term prospects. US Foods Holding has an Earnings Estimate Revisions Grade of C, based on a score of 48, which is neutral. The grade is based on the statistical significance of its latest two quarterly earnings surprises and the percentage change in its consensus estimate for the current fiscal year over the past month and past three months. The company reported a negative earnings surprise of 2.1% for the first quarter of 2025, and in the prior quarter reported a positive earnings surprise of 4.3%. Over the last month, the consensus earnings estimate for the second quarter of 2025 has increased from $0.118 to $1.124 per share based on seven upward and two downward revisions. Over the last month, the consensus earnings estimate for full-year 2025 remained relatively unchanged at $3.812 per share.

US Foods Holding has a Growth Grade of A, which is very strong. The company has a five-year sales growth rate of 7.9%, and sales have increased year over year in four of the past five years. Cash from operations has been positive in the past five consecutive years.

Walgreens Boots Alliance Inc. (WBA) is a global leader in retail pharmacy and health care services, offering prescription medications, health and wellness products, and pharmacy-led services through over 12,000 retail locations across the U.S., Europe and Latin America. Headquartered in Deerfield, Illinois, the company operates under the Walgreens and Boots brands, integrating pharmacy operations with clinical services, immunizations, diagnostic testing and digital health solutions. Its product portfolio includes pharmaceuticals, personal care, beauty and convenience items, with a growing emphasis on private labels and wellness-focused offerings. Walgreens continues to invest in digital transformation through omnichannel strategies and platforms like the Walgreens app, while advancing sustainability goals related to carbon reduction, waste management and health equity.

Walgreens has a Quality Grade of C, based on a score of 51, which is average. Its change in total liabilities to assets of –8.4% ranks in the 85th percentile, and its gross income to assets of 37.6% ranks in the 80th percentile. Its buyback yield of –0.2% ranks in the 59th percentile.

Walgreens has a Value Grade of B, based on a score of 65, which is good value. The company ranks in the 80th percentile for its enterprise-value-to-EBITDA ratio and in the 53rd percentile for its shareholder yield. The company has an enterprise-value-to-EBITDA ratio of 21.7 and a shareholder yield of –0.2%. A lower price-to-book ratio is considered better value, and Walgreens’ price-to-book ratio of 0.81 is well below the sector median of 2.28.

The company has a Growth Grade of A, which is very strong. The company has generated positive annual cash from operations in the past five consecutive years and has a five-year annualized sales growth rate of 4.2%. Cash from operations has also been positive in the past five consecutive years.