Weekly Stock Ideas: Checking the Investor Premium of Three Insurance Stocks

This week, we use AAII’s A+ Investor Stock Grades to provide insight into three insurance stocks. With the insurance industry expected to grow 7.2% by 2028, should you consider the three insurance stocks of Cincinnati Financial Corp. (CINF), Mercury General Corp. (MCY) and Universal Insurance Holdings Inc. (UVE)?

Insurance Stocks Recent News

The insurance industry is experiencing a wave of positive developments, driven by investment, innovation and modernization. Parametric insurance—where payouts are based on a particular risk reaching predetermined levels—is gaining traction as a flexible solution for hard-to-cover risks, offering faster payouts and expanded protection. Enterprise software providers in the insurance space are reporting strong earnings growth, supported by increased cloud adoption and improved operational efficiency. Additionally, large-scale investments in insurance brokerages are enhancing financial flexibility and fueling expansion, signaling strong confidence in the sector’s future.

According to The Business Research Co., the global insurance industry is projected to grow from $7.79 trillion in 2024 to $10.29 trillion by 2028, for a compound annual growth rate (CAGR) of 7.2%. This growth is fueled by digital transformation, increased demand for cyber insurance and advancements in data analytics. Technologies like artificial intelligence (AI) and machine learning are enhancing efficiency, while demographic shifts and climate-related risks are driving demand for innovative and personalized insurance solutions. Given these projections, insurance companies such as Cincinnati Financial, Mercury General and Universal Insurance Holdings could be worth examining.

Grading Insurance Stocks With AAII’s A+ Stock Grades

When analyzing a company, it is helpful to have an objective framework that allows you to compare companies in the same way. This is why AAII created the A+ Stock Grades, which evaluate companies across five factors that research and real-world investment results indicate to identify market-beating stocks in the long run: value, growth, momentum, earnings estimate revisions (and surprises) and quality.

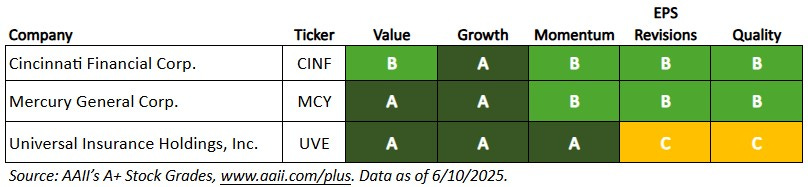

Using AAII’s A+ Stock Grades, the following table summarizes the attractiveness of three insurance stocks—Cincinnati Financial, Mercury General and Universal Insurance Holdings—based on their fundamentals.

AAII’s A+ Stock Grade Summary for Three Insurance Stocks

What the A+ Stock Grades Reveal

Cincinnati Financial Corp. (CINF) is a publicly traded insurance holding company headquartered in Fairfield, Ohio, and established in 1950. The company offers a broad spectrum of insurance products, including commercial and personal lines, life insurance, and excess and surplus lines, primarily distributed via a network of over 2,700 independent agencies across 45 U.S. states. In 2024, Cincinnati Financial reported revenues of $11.34 billion and net income of $2.29 billion, reflecting a 13.2% increase in revenue and a 24.4% rise in net income compared to the previous year. The company’s business model emphasizes disciplined underwriting, a diversified investment portfolio and a customer-centric approach, which includes significant investments in digital transformation and cybersecurity.

Cincinnati Financial has a Momentum Grade of B, based on its Momentum Score of 65. This means that the stock’s momentum is strong in terms of its weighted relative price strength over the last four quarters. The weighted four-quarter relative strength rank is the relative price change for each of the past four quarters, with the most recent quarterly price change given a weight of 40% and each of the three previous quarters given a weight of 20%. The ranks are 55, 49, 64 and 84, sequentially from the most recent quarter. The weighted four-quarter relative price strength is 2.0%.

A higher-quality stock possesses traits associated with upside potential and reduced downside risk. Backtesting of the Quality Grade shows that stocks with higher grades, on average, outperformed stocks with lower grades from 1998 through 2019.

The A+ Quality Grade is the percentile rank of the average of the percentile ranks of return on assets (ROA), return on invested capital (ROIC), gross profit to assets, buyback yield, change in total liabilities to assets, accruals to assets, Z double prime bankruptcy risk (Z) score and F-Score. The score is variable, meaning it can consider all eight measures or, should any of the eight measures not be valid, the valid remaining measures. To be assigned a Quality Score, though, stocks must have a valid (non-null) measure and corresponding ranking for at least four of the eight quality measures.

Cincinnati Financial has a Quality Grade of B, based on a score of 66, which is strong. The company ranks strongly in terms of return on assets, return on invested capital and F-Score. Its return on assets is 4.1%, ranking in the 69th percentile among all U.S.-listed stocks. Its return on invested capital of 278.1% ranks in the 98th percentile, and its F-Score of 6 ranks in the 70th percentile. The F-Score is a number between 0 and 9 that assesses the strength of a company’s financial position. It considers the profitability, leverage, liquidity and operating efficiency of a company. Cincinnati Financial also has a buyback yield of 0.3%, which is above the sector median of –0.2% and ranks in the 71st percentile.

The components of the Growth Composite Score consider a company’s success in growing sales on a year-over-year and long-term annualized basis and its ability to consistently generate positive cash from its core operations. The company’s Growth Grade is A, which is very strong. Cincinnati Financial has generated positive annual cash from operations in the past five consecutive years and has a five-year annualized sales growth rate of 7.4%.

Mercury General Corp. (MCY) is a publicly traded insurance holding company headquartered in Los Angeles, California. Established in 1961, the company primarily offers personal automobile and homeowners insurance, operating in 11 U.S. states. Mercury General is recognized for its disciplined underwriting practices and commitment to low operating costs. In 2024, the company reported net premiums earned of $4.27 billion and net income of $96.3 million, a significant turnaround from a net loss in 2023. The company maintains a conservative investment approach and emphasizes fraud prevention and customer service. Founder and chairman George Joseph remains actively involved in the business at the age of 103, with his son Victor Joseph serving as president and chief operating officer (COO).

The company has a Value Grade of A, based on its Value Score of 86, which is deep value. The Value Grade is the percentile rank of the average of the percentile ranks of the price-to-sales (P/S) ratio, price-earnings (P/E) ratio, price-to-book-value (P/B) ratio, price-to-free-cash-flow (P/FCF) ratio, shareholder yield and the ratio of enterprise value to earnings before interest, taxes, depreciation and amortization (EBITDA).

The company has a price-to-free-cash-flow ratio of 5.5%, ranking in the 11th percentile among all U.S.-listed stocks. Its enterprise-value-to-EBITDA ratio is 6.1, ranking in the 15th percentile. The price-to-sales ratio of 0.65 ranks in the 24th percentile.

Earnings estimate revisions indicate how analysts view a firm’s short-term prospects. Mercury General has an Earnings Estimate Revisions Grade of B, based on a score of 68, which is positive. The grade is based on the statistical significance of its latest two quarterly earnings surprises and the percentage change in its consensus estimate for the current fiscal year over the past month and past three months.

Mercury General reported a positive earnings surprise of 42.8% for the first quarter of 2025, and in the prior quarter reported a positive earnings surprise of 334.4%. Over the last month, the consensus earnings estimate for the second quarter of 2025 has increased from a loss of $0.10 to a gain of $1.30 per share based on one upward revision. Over the last month, the consensus earnings estimate for full-year 2025 has increased from a loss of $0.50 to a gain of $2.45 per share based on one upward revision.

Mercury General has a Growth Grade of A, which is very strong. The company has a five-year annualized sales growth rate of 6.6%, compared to the sector median of 6.1%. It has generated positive annual cash from operations in the past five consecutive years.

Universal Insurance Holdings Inc. (UVE) is a publicly traded property and casualty insurance company headquartered in Fort Lauderdale, Florida. Established in 1991, the company primarily offers personal residential homeowners insurance and operates in 19 U.S. states. In 2024, Universal Insurance Holdings reported annual revenue of $1.52 billion, up 9.27% from the previous year, and net income of $58.93 million. The company experienced challenges in the fourth quarter, with net income declining year over year from $20.0 million to $6.02 million, due to increased weather-related losses from Hurricanes Debbie, Helene and Milton. Despite these challenges, Universal Insurance Holdings’ direct premiums written increased 8% year over year, and the company expanded its market presence by entering Wisconsin, its 19th state. Universal Insurance Holdings continues to focus on strategic growth, disciplined underwriting and maintaining strong reinsurance relationships to enhance financial resilience. The company also returned capital to shareholders through share repurchases and dividends.

Universal Insurance Holdings has a Quality Grade of C, based on a score of 48, which is average. The company ranks strongly in terms of its buyback yield and its F-Score, both of which rank in the 85th percentile among all U.S.-listed stocks. Its buyback yield is 2.7%, and its F-Score is 7. Universal Insurance Holdings’ return on assets of 2.8% ranks in the 62nd percentile.

The company has a Value Grade of A, based on a score of 93, which is deep value. A lower price-to-free-cash-flow ratio is considered better value, and Universal Insurance Holdings’ price-to-free-cash-flow ratio of 3.5 ranks in the 7th percentile and is below the sector median of 13.5. Its enterprise-value-to-EBITDA ratio of 3.3 ranks in the 6th percentile. The company’s shareholder yield is 5.6%, which is above the sector median of 2.4%.

Universal Insurance Holdings has a Momentum Grade of A, based on its Momentum Score of 84. This means that the stock’s momentum is very strong in terms of its weighted relative price strength over the last four quarters. The ranks are 86, 60, 44 and 78, sequentially from the most recent quarter. The weighted four-quarter relative price strength is 8.9%.