Watching the Flow in Three Capital Markets Stocks

With rate cuts expected, see how AAII’s A+ Stock Grades rate Federated Hermes, Janus Henderson & SEI Investments in the capital markets sector.

This week, we use AAII’s A+ Investor Stock Grades to provide insight into three stocks in the capital markets industry. With interest rate cuts on the horizon and earnings strength across the industry, should you consider the three investment management firms of Federated Hermes Inc. (FHI), Janus Henderson Group PLC (JHG) and SEI Investments Co. (SEIC)?

Capital Markets Stocks Recent News

Investors are watching closely as the Federal Reserve prepares for its next move on interest rates. The CME FedWatch Tool shows a 96.0% probability of a 25-basis-point cut at the upcoming September 17 Federal Open Market Committee (FOMC) meeting. Such a move would lower borrowing costs, reduce the appeal of holding cash and typically stimulate investment across equities, fixed income and multi-asset strategies.

This shift in expectations is already showing up in market activity. According to Tradeweb Markets Inc. (TW), a leading platform for fixed-income and derivatives trading, average daily volume (ADV) across all markets reached $2.5 trillion in August 2025, up 11.3% year over year. Total trading in all rate derivatives rose 20.8% year over year to $878.5 billion. Tradeweb attributed the increase to growing investor activity ahead of expected interest rate cuts, with more risk trading driven by economic data and Fed speculation.

Capital market firms like Federated Hermes, Janus Henderson and SEI Investments appear poised to benefit. Federated Hermes reported second-quarter 2025 earnings of $1.16 per share, coming in 8.5% above the S&P Global consensus estimate. Janus Henderson earned $0.90 per share for the second quarter, beating the consensus estimate by 7.8%, while SEI Investments recorded earnings of $1.78 per share for the second quarter, beating the consensus estimate by 48.8%. With interest rates expected to decline and market participation picking up, these firms may be in a favorable position to benefit.

Sign Up to Receive a Free Special Report That Shows How A+ Investor Grades Can Help You Make Investment Decisions

Grading Capital Markets Stocks With AAII’s A+ Stock Grades

When analyzing a company, it is helpful to have an objective framework that allows you to compare companies in the same way. This is why AAII created the A+ Stock Grades, which evaluate companies across five factors that research and real-world investment results indicate to identify market-beating stocks in the long run: value, growth, momentum, earnings estimate revisions (and surprises) and quality.

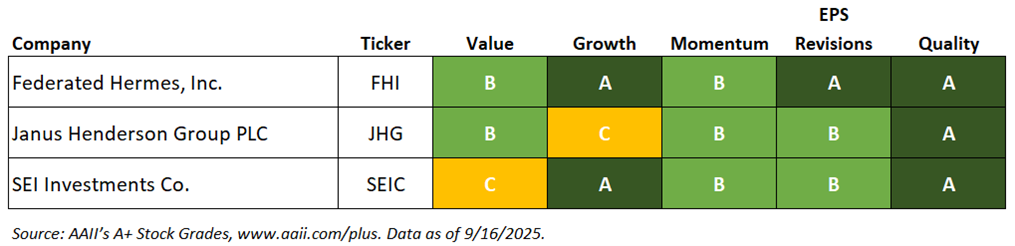

Using AAII’s A+ Stock Grades, the following table summarizes the attractiveness of three capital markets stocks—Federated Hermes, Janus Henderson and SEI Investments—based on their fundamentals.

AAII’s A+ Stock Grade Summary for Three Capital Markets Stocks

What the A+ Stock Grades Reveal

Federated Hermes Inc. (FHI) is a publicly owned investment manager. Through its subsidiaries, the firm provides its services to individuals, including high net worth individuals, banking or thrift institutions, investment companies, pension and profit-sharing plans, pooled investment vehicles, charitable organizations, state or municipal government entities, and registered investment advisers. Through its subsidiaries, it manages separate client-focused equity, fixed-income, balanced and money market mutual funds along with separate client-focused equity, fixed-income, money market and balanced portfolios. It employs both fundamental and quantitative analysis to make its equity investments. Federated Hermes was founded in 1955 and is based in Pittsburgh, Pennsylvania, with additional offices in New York City, New York, and London, U.K.

Federated Hermes has a Momentum Grade of B, based on its Momentum Score of 78. This means that the stock’s momentum has been strong in terms of its weighted relative price strength over the last four quarters. The weighted four-quarter relative strength rank is the relative price change for each of the past four quarters, with the most recent quarterly price change given a weight of 40% and each of the three previous quarters given a weight of 20%. The ranks are 76, 66, 52 and 81, sequentially from the most recent quarter. The weighted four-quarter relative price strength is 8.2%.

A higher-quality stock possesses traits associated with upside potential and reduced downside risk. Backtesting of the Quality Grade shows that stocks with higher grades, on average, outperformed stocks with lower grades from 1998 through 2019.

The A+ Quality Grade is the percentile rank of the average of the percentile ranks of return on assets (ROA), return on invested capital (ROIC), gross income to assets, buyback yield, change in total liabilities to assets, accruals to assets, Z double prime bankruptcy risk (Z) score and F-Score. The score is variable, meaning it can consider all eight measures or, should any of the eight measures not be valid, the valid remaining measures. To be assigned a Quality Score, though, stocks must have a valid (non-null) measure and corresponding ranking for at least four of the eight quality measures.

Federated Hermes has a Quality Grade of A, based on a score of 97, which is very strong. The company ranks strongly in terms of its return on assets and buyback yield. Its return on assets of 17.9% ranks in the 95th percentile among all U.S.-listed stocks, and its buyback yield of 6.2% ranks in the 94th percentile. Federated Hermes also has an F-Score of 7, which is above the sector median of 4 and ranks in the 84th percentile. The F-Score is a number between 0 and 9 that assesses the strength of a company’s financial position. It considers the profitability, leverage, liquidity and operating efficiency of a company.

The components of the Growth Composite Score consider a company’s success in growing sales on a year-over-year and long-term annualized basis and its ability to consistently generate positive cash from its core operations. The company’s Growth Grade is A, which is very strong. Federated Hermes has generated positive annual cash from operations in the past five consecutive years and has a five-year annualized sales growth rate of 4.2%.

Janus Henderson Group PLC (JHG) is an asset management holding entity. Through its subsidiaries, the firm provides services to institutional, retail and high-net-worth clients. It manages separate client-focused equity and fixed-income portfolios. The firm also manages equity, fixed-income and balanced mutual funds for its clients. It specializes in growth capital, middle market and buyout investments. It invests between $10 million and $30 million in public equity, fixed-income markets, real estate and private equity. The firm invests in companies based in China and India. Janus Henderson was founded in 1934 and is based in London, U.K., with additional offices in Jersey, U.K., and Sydney, Australia.

Janus Henderson has a Value Grade of B, based on its Value Score of 67, which is good value. The Value Grade is the percentile rank of the average of the percentile ranks of the price-to-sales (P/S) ratio, price-earnings (P/E) ratio, price-to-book-value (P/B) ratio, price-to-free-cash-flow (P/FCF) ratio, shareholder yield and the ratio of enterprise value to earnings before interest, taxes, depreciation and amortization (EBITDA).

The company has a price-earnings ratio of 16.7, ranking in the 41st percentile. Its enterprise-value-to-EBITDA ratio is 9.2 and its shareholder yield is 4.7%, ranking in the 32nd and 17th percentiles, respectively. The price-to-book ratio of 1.45 ranks in the 39th percentile.

Earnings estimate revisions indicate how analysts view a firm’s short-term prospects. Janus Henderson has an Earnings Estimate Revisions Grade of B, based on a score of 73, which is positive. The grade is based on the statistical significance of its latest two quarterly earnings surprises and the percentage change in its consensus estimate for the current fiscal year over the past month and past three months.

Janus Henderson reported a positive earnings surprise of 7.8% for the second quarter of 2025, and in the prior quarter reported a positive earnings surprise of 9.3%. Over the last three months, the consensus earnings estimate for the third quarter of 2025 has increased from $0.856 to $0.956 per share. The consensus earnings estimate for full-year 2025 has increased from $3.370 to $3.671 per share.

Janus Henderson has a Growth Grade of C, which is average. The company ranks in the 60th percentile for its five-year annualized sales growth rate of 2.4%.

SEI Investments Co. (SEIC) is a publicly owned asset management holding company. Through its subsidiaries, the firm provides wealth management, retirement and investment solutions, asset management, asset administration, investment processing outsourcing solutions, financial services, and investment advisory services to its institutional clients. It also launches and manages equity, fixed-income and balanced mutual funds. The firm invests in public equity and fixed-income markets. It employs fundamental and quantitative analysis with a focus on top-down and bottom-up analysis to make its investments. SEI Investments was founded in 1968 and is based in Oaks, Pennsylvania, with additional offices in North America, Europe, Asia and Africa.

SEI Investments has a Quality Grade of A, with a score of 98, which is very strong. The company ranks strongly in terms of its Z-Score and its return on assets. Its Z-Score of 17.77 ranks in the 96th percentile among all U.S.-listed stocks, and its return on assets of 26.7% ranks in the 98th percentile. SEI Investments has a ratio of gross income to assets of 66.2%, above the sector median of 4.0%, and a buyback yield of 4.9%.

SEI Investments has a Value Grade of C, based on a score of 46, which is average. The company ranks in the 12th percentile for its shareholder yield and in the 43rd percentile for its enterprise-value-to-EBITDA ratio. It has a shareholder yield of 6.0% and an enterprise-value-to-EBITDA ratio of 11.2. SEI Investments’ price-earnings ratio of 16.4 ranks in the 40th percentile, above the sector median of 13.0. The price-to-free-cash-flow ratio is 22.6, which ranks in the 54th percentile.

The company has a Momentum Grade of B, based on its Momentum Score of 61. This means that the stock’s momentum is average in terms of its weighted relative price strength over the last four quarters. The ranks are 43, 73, 40 and 85, sequentially from the most recent quarter. The weighted four-quarter relative price strength is 1.6%.

SEI Investments has a Growth Grade of A, which is very strong. The company ranks in the 100th percentile for its five-year annualized sales growth rate of 5.2%.