Three Semiconductor Stocks That May Be Wired for Growth

See how Cirrus Logic (CRUS), Penguin Solutions (PENG) and Photronics (PLAB) rank with AAII’s A+ Stock Grades as AI fuels a $1T semiconductor market by 2030.

This week, we use AAII’s A+ Investor Stock Grades to provide insight into three semiconductor stocks. With semiconductor revenue projected to reach $1.0 trillion annually by 2030, should you consider the three stocks of Cirrus Logic Inc. (CRUS), Penguin Solutions Inc. (PENG) and Photronics Inc. (PLAB)?

Semiconductor Stocks Recent News

The semiconductor industry is expected to continue its growth trajectory in 2025, fueled by rising demand for advanced chips used in artificial intelligence (AI) applications. According to McKinsey & Co., the global semiconductor market could reach $1.0 trillion in annual revenue by 2030, with an additional $300 billion potentially contributed by the computing needs of generative AI.

To support this demand, major industry players are scaling up investments and innovation. Nvidia Corp. (NVDA) announced plans to invest up to $100 billion to develop AI data centers in collaboration with OpenAI. Taiwan Semiconductor Manufacturing Co. (TSM), the world’s largest contract chipmaker, reported second-quarter 2025 revenue of $31.9 billion, up 54.0% year over year, largely driven by AI chip production. Microsoft Corp. (MSFT) introduced a new chip cooling technology.

As AI adoption expands, so does the need for microprocessors, graphics processing units (GPUs) and specialized AI chips. Companies such as Cirrus Logic, Penguin Solutions and Photronics participate in key segments of the semiconductor supply chain and may be poised to benefit.

Sign Up to Receive a Free Special Report That Shows How A+ Investor Grades Can Help You Make Investment Decisions

Grading Semiconductor Stocks With AAII’s A+ Stock Grades

When analyzing a company, it is helpful to have an objective framework that allows you to compare companies in the same way. This is why AAII created the A+ Stock Grades. They evaluate companies across five factors that research and real-world investment results indicate to identify market-beating stocks in the long run: value, growth, momentum, earnings estimate revisions (and surprises) and quality.

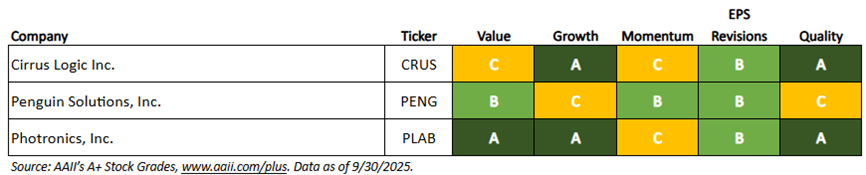

Using AAII’s A+ Stock Grades, the following table summarizes the attractiveness of three semiconductor stocks—Cirrus Logic, Penguin Solutions and Photronics —based on their fundamentals.

AAII’s A+ Stock Grade Summary for Three Semiconductor Stocks

What the A+ Stock Grades Reveal

Cirrus Logic Inc. (CRUS) is a semiconductor company that designs and sells low-power, high-precision mixed-signal processing solutions for global markets. The company specializes in audio products. Its SoundClear portfolio includes tools, software and algorithms designed to enhance sound quality, voice capture and hearing augmentation for a range of devices and systems. Cirrus Logic also provides high-performance mixed-signal products, such as camera controllers, haptic and sensing solutions, and battery and power integrated circuits. These products are used in smartphones, industrial applications and energy systems. The company distributes its products through a direct sales force, external sales representatives and distributors. Cirrus Logic was incorporated in 1984 and is headquartered in Austin, Texas.

Cirrus Logic has a Value Grade of C, based on its Value Score of 50, which is average. Higher scores indicate a more attractive stock for value investors and, thus, a better grade. The Value Grade is the percentile rank of the average of the percentile ranks of the price-to-sales (P/S) ratio, price-earnings (P/E) ratio, price-to-book-value (P/B) ratio, price-to-free-cash-flow (P/FCF) ratio, shareholder yield and the ratio of enterprise value to earnings before interest, taxes, depreciation and amortization (EBITDA).

The company has a shareholder yield of 3.2%, ranking in the 24th percentile among all U.S.-listed stocks. Its price-to-free-cash-flow ratio is 14.4 and its price-earnings ratio is 19.6, ranking in the 36th and 48th percentiles, respectively. The enterprise-value-to-EBITDA ratio is 11.7, ranking in the 46th percentile.

Cirrus Logic has a Momentum Grade of C, based on its Momentum Score of 55. This means that the stock’s momentum is average in terms of its weighted relative price strength over the last four quarters. The weighted four-quarter relative strength rank is the relative price change for each of the past four quarters, with the most recent quarterly price change given a weight of 40% and each of the three previous quarters given a weight of 20%. The ranks are 69, 57, 61 and 24, sequentially from the most recent quarter, with higher ranks signaling stronger price momentum. The weighted four-quarter relative price strength is –0.6%.

Cirrus Logic has a Growth Grade of A, which is very strong. The components of the Growth Composite Score consider a company’s success in growing sales on a year-over-year and long-term annualized basis and its ability to consistently generate positive cash from its core operations. The company has a five-year annualized sales growth rate of 8.2% and has generated positive annual cash from operations in the past five consecutive years.

Penguin Solutions Inc. (PENG) designs and develops enterprise solutions worldwide through three segments: advanced computing, integrated memory and optimized LED. It offers dynamic random-access memory (DRAM) modules, solid-state and flash storage, and other advanced memory solutions for networking, telecommunications, data analytics, AI and machine learning, along with supply chain services such as procurement, logistics, inventory management, temporary warehousing, programming, kitting and packaging. Its Penguin Computing brand focuses on high-performance computing and AI for core and cloud environments. Its Penguin Edge brand delivers edge computing solutions for embedded and wireless applications in government, health care, manufacturing and telecommunications. The company also offers Stratus, which provides simplified, fault-tolerant computing for data centers and edge environments, serving the education, energy, finance, government, hyperscale and manufacturing markets. Additionally, it produces LED chips based on gallium nitride under the Cree LED brand and surface mount devices under the XLamp and J Series brands. Products are sold to original equipment manufacturers (OEMs), enterprises, governments and other end users through direct sales, e-commerce, field engineers, independent representatives, distributors and resellers. Formerly SMART Global Holdings Inc., the company changed its name to Penguin Solutions Inc. in October 2024. It is headquartered in Milpitas, California.

Penguin Solutions has a Quality Grade of C, based on a score of 54, which is average. Higher-quality stocks possess traits associated with upside potential and reduced downside risk. The Quality Grade is the percentile rank of the average of the percentile ranks of return on assets (ROA), return on invested capital (ROIC), gross income to assets, buyback yield, change in total liabilities to assets, accruals to assets, Z double prime bankruptcy risk (Z) score and F-Score. To be assigned a Quality Score, stocks must have a valid (non-null) measure and corresponding ranking for at least four of the eight quality measures.

Penguin Solutions ranks strongly in terms of its gross income to assets and Z-Score. It has a ratio of gross income to assets of 21.4% and a Z-Score of 6.94. The Z-Score predicts financial distress based on five fundamental variables, and a score below 1.80 indicates that a firm is likely headed for bankruptcy. One of the weak components in the stock’s Quality Grade is its return on invested capital of 8.6%, which ranks in the lowest 37th percentile of all stocks.

Penguin Solutions has a Value Grade of B, based on a score of 65, which is good value. The company ranks in the cheapest 32nd percentile for its price-to-sales ratio and in the cheapest 33rd percentile for its enterprise-value-to-EBITDA ratio. The company has a price-to-sales ratio of 1.03 and an enterprise-value-to-EBITDA ratio of 9.6. It also has a price-to-free-cash-flow ratio of 9.3, ranking in the 20th percentile.

The company has a Momentum Grade of B, based on its Momentum Score of 74. This means that the stock’s momentum is strong in terms of its weighted relative price strength over the last four quarters. The ranks are 83, 69, 43 and 37, sequentially from the most recent quarter. The weighted four-quarter relative price strength is 6.0%.

Photronics Inc. (PLAB), together with its subsidiaries, engages in the manufacture and sale of photomask products and services in the U.S. and internationally. It offers photomasks that are used in the manufacture of integrated circuits and flat panel displays (FPDs). Its photomasks are also used to transfer circuit patterns onto semiconductor wafers and FDP substrates. The company offers electrical and optical components. It sells its products to semiconductor and FPD designers, manufacturers and foundries, as well as to other high-performance electronics manufacturers through its sales personnel and customer service representatives. The company was formerly known as Photronic Labs Inc. and changed its name to Photronics Inc. in 1990. Photronics Inc. was incorporated in 1969 and is based in Brookfield, Connecticut.

Photronics has a Quality Grade of A, based on a score of 88, which is very strong. The company ranks strongly in terms of its return on assets and buyback yield. Its return on assets of 6.4% ranks in the 78th percentile among all U.S.-listed stocks, and its buyback yield of 6.3% ranks in the 94th percentile. Photronics also has a Z-Score of 13.36, ranking in the 94th percentile.

The company’s Growth Grade is A, which is very strong. Photronics has realized positive annual cash from operations in the past five consecutive years. It also has a five-year annualized sales growth rate of 9.5%.

Earnings estimate revisions indicate whether analysts’ expectations for the firm’s profits have improved or worsened. Photronics has an Earnings Estimate Revisions Grade of B, based on a score of 67, which is positive. The grade is based on the statistical significance of its latest two quarterly earnings surprises and the increases in its consensus earnings estimate for the current fiscal year over the past month and past three months.

Photronics reported fiscal third-quarter 2025 earnings of $0.510 per share, compared to the consensus estimate of $0.385 per share, for a positive earnings surprise of 32.5%. Over the last month, the consensus earnings estimate for fiscal-year 2025 ending in October has risen from $1.725 to $1.870 per share.