The Great Migration: What’s Behind ETF Asset Growth

Featured Tickers:VTSAX

Why asset managers convert mutual funds to ETFs

How conversions and ETF share classes work

Investor pros and cons of ETF conversions, including performance realities, liquidity and transparency

A growing number of asset managers are converting traditional mutual funds into exchange-traded funds (ETFs) or preparing to offer ETFs as a mutual fund share class. This is being done in response to investors who increasingly favor lower costs, tax efficiency and intraday trading flexibility.

Rather than launching new strategies from scratch, conversions allow asset managers to leverage proven track records, retain assets and modernize their offerings without abandoning well-known fund lineups. A new ETF share class within a mutual fund with a well-known track record can gain investor trust.

An ETF conversion occurs when an existing mutual fund is reorganized into an ETF with the same underlying portfolio. The conversion typically happens on a tax-free basis for shareholders, meaning investors receive ETF shares in place of their mutual fund shares without realizing capital gains at the time of the conversion. After the conversion, the fund operates under the ETF structure, with different trading mechanics, expenses and features.

Industry Developments

Since our October 2024 AAII Journal column on ETF conversions, industry developments have helped accelerate both the rollout of ETFs and the growth of their assets.

Investor Adoption of ETFs Grows

Despite mutual funds still holding far more assets, investor appetite for ETFs remains robust. U.S.-listed ETFs attracted $147.7 billion in November 2025, according to FactSet as reported by ETF.com. This amount fell short of a record $176 billion in October 2025. Heading into December, year-to-date inflows have surged to $1.27 trillion, already setting an annual record.

According to a 2025 survey by Charles Schwab, 93% of ETF investors see ETFs as a necessary part of their portfolio; 61% increased their ETF allocations in 2025, and 75% are extremely likely to purchase ETFs in the next two years.

ETFs as Mutual Fund Share Classes Arise

Mutual funds typically offer investors access to multiple share classes. Vanguard enhanced that structure in May 2001 when it added an ETF as a new share class of Vanguard Total Stock Market Index Admiral fund (VTSAX). This enhancement provided Vanguard’s clients with a choice of investing in the fund through either a mutual fund or ETF, extending ETF tax benefits to mutual fund shares. Vanguard held a patent on this structure for its index-based mutual funds until May 2023.

Asset managers have taken advantage of this patent expiration by submitting applications to the U.S. Securities and Exchange Commission (SEC) for exemptive relief that would permit mutual funds to offer an ETF share class of an existing portfolio. On November 17, 2025, the SEC approved Dimensional Fund Advisors to launch an ETF share class for 13 of its existing mutual funds. This milestone could pave the way for asset managers to deliver streamlined investment solutions, and it may spark a faster shift of assets into ETFs. The dual share class is a mechanism for mutual fund strategies to offer ETFs without having to launch a new stand-alone ETF or convert a mutual fund into an ETF.

How Do Converted ETFs Stack Up?

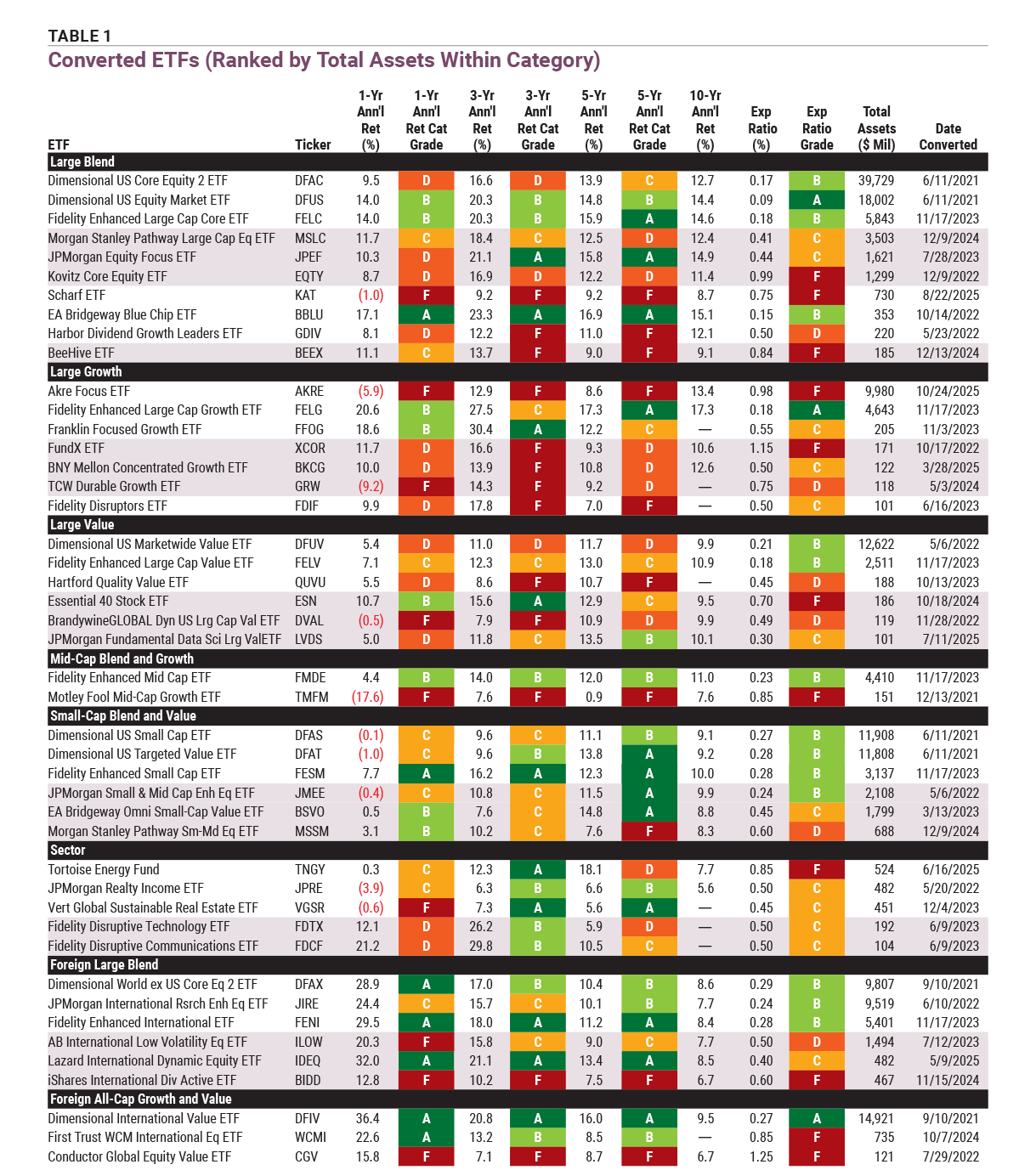

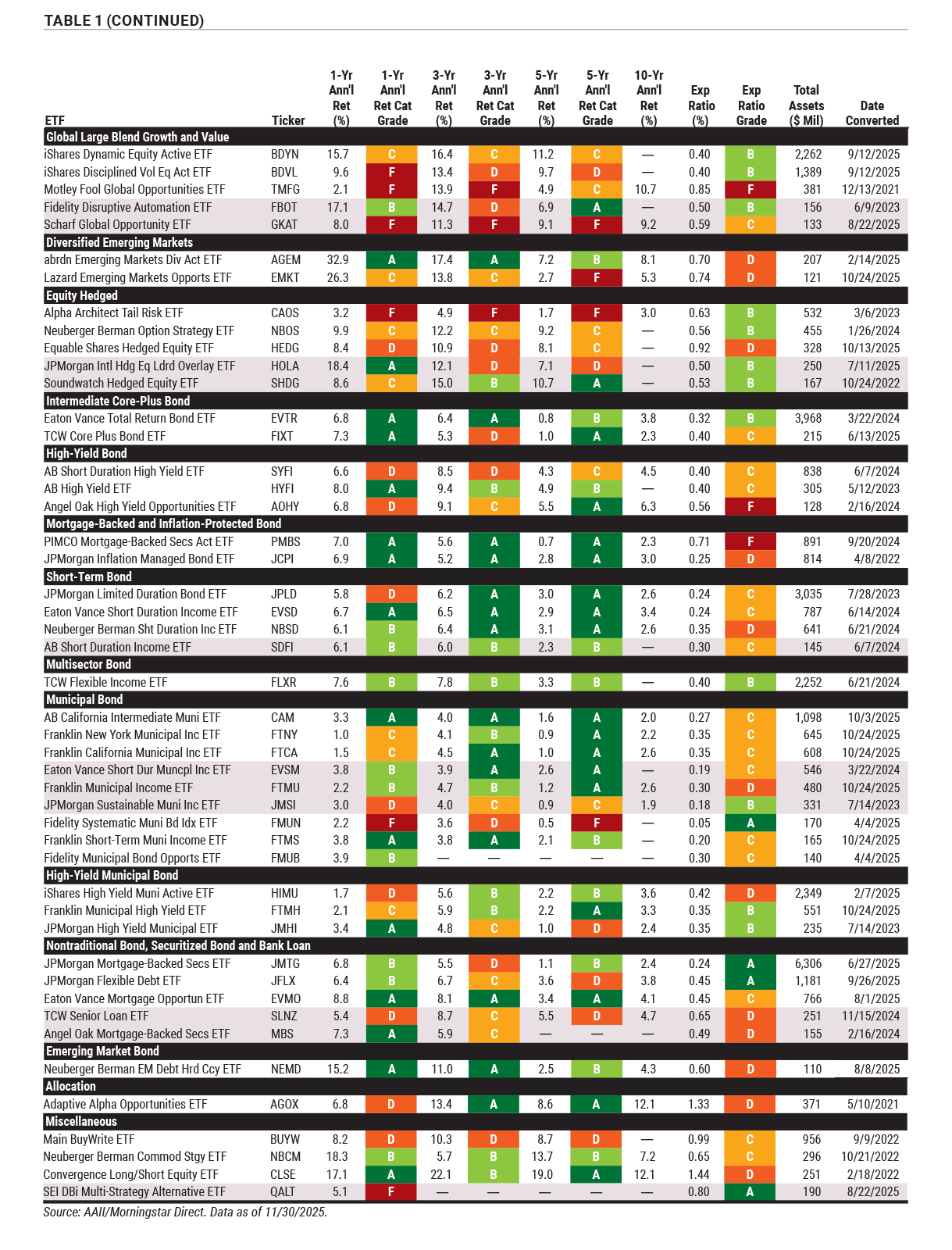

The converted ETFs shown in Table 1 are displayed by category and ranked by total assets within the category. We only included ETFs with $100 million or more in assets under management (AUM). The average expense ratio is 0.49%. The expense ratios of the ETFs in Table 1 tend to be average and above average (expensive). Of the 92 ETFs in Table 1, 32 have A+ Investor Grades of A or B for their expense ratios, 32 have grades of D or F, and the remaining 28 have grades of C. All ETFs in the table are actively managed.

Even with potential tax advantages, converted ETFs haven’t consistently outperformed. Only 10 (10.9%) of the ETFs in Table 1 have earned A+ Investor Grades of A for the one-, three- and five-year return periods. This grade applies to ETF returns ranking in the top 20% of their category. Five ETFs in the table have returns in the lowest 20% of their category as well as expense ratios ranking in the most expensive 20% of their category.

Download the Excel spreadsheet for Table 1.

Benefits and Drawbacks for Investors

Both converted ETFs and mutual fund ETF share classes present advantages and tradeoffs. ETF investors benefit from tax efficiency, low expenses and tradability compared to mutual funds.

Mutual funds are priced once per day and traded directly with the fund company, while ETFs trade on an exchange throughout the day. Investors can only trade mutual fund shares at the end of the day at the closing net asset value (NAV). ETFs generally provide intraday liquidity and allow investors to use limit orders. Investors can sell ETFs short to profit from falling prices, buy them on margin to increase potential gains (with higher risk), trade options on them to hedge or speculate, and lend ETFs to other investors to earn fees. Plus, the involvement of authorized participants (typically large trading firms) provides volume and helps ETFs trade at or near their NAV. Combined, these characteristics make ETFs a cost-efficient and adaptable choice for investors. In many cases, ETFs feature lower expense ratios compared to mutual funds.

ETFs offer tax efficiency due to in-kind redemptions, while mutual funds may distribute comparatively more capital gains to shareholders. When investors redeem ETF shares, authorized participants typically exchange them for the underlying securities rather than cash, which avoids triggering capital gains at the fund level. Both ETFs and mutual funds can realize capital losses in their portfolios to offset gains, minimizing taxable distributions to shareholders.

ETFs do not sell holdings to meet investor redemptions, unlike mutual funds. However, gains may be realized and distributions may occur when a holding is removed due to index rebalancing or when the ETF portfolio changes materially. ETF shareholders in a dual share class fund may incur capital gains that an ETF could otherwise offset if it operated as a stand-alone fund.

ETF prices fluctuate throughout the trading day based on supply and demand, which can cause them to trade at prices different from their NAV. An ETF’s NAV is updated frequently during the day, and the ETF can trade at a premium (above NAV) or a discount (below NAV). These differences can arise from investor sentiment, intraday trading activity, limited ETF trading volume or less liquid underlying assets. In some cases, the ETF may be easier to trade than its underlying securities. Lower ETF trading volume could lead to wider bid-ask spreads and make it more difficult to sell ETF shares quickly, especially during periods of downward volatility. Mutual funds can always be sold at their NAV.

Passively managed ETFs tracking an index disclose their holdings daily. Full transparency can expose actively managed ETF trades, allowing others to front-run transactions or reveal proprietary portfolio construction. To address this, active ETFs may limit daily disclosure so managers can trade without signaling their intentions to the market. Lack of transparency increases the potential for wider premiums or discounts to NAV. When holdings are less transparent, pricing becomes more uncertain, which, in turn, can widen bid-ask spreads. These conditions allow premiums and discounts to exist.

Other Investor Considerations

Investments in and redemption of mutual funds can be made in a dollar amount chosen by the investor, rather than in whole shares. The ability to buy fractional shares makes mutual funds convenient for making regular contributions to accounts via methods such as dollar-cost averaging. Accumulators may not be able to buy fractional shares of the ETF depending on the broker they use.

ETFs held in retirement accounts such as 401(k)s and individual retirement accounts (IRAs) lose their tax advantages, but they offer possible benefits in terms of fees, flexibility and ease of trading. A downside of this is not being able to transact at NAV and potentially not being able to sell fractional shares to match an exact required minimum distribution (RMD) amount.

After conversion, ETF shareholders will need a brokerage account, versus directly holding mutual fund shares. Some mutual fund companies do offer brokerage accounts, including, but not limited to, Fidelity, Vanguard and T. Rowe Price.