The Bond Market Is Adjusting, Not Growling

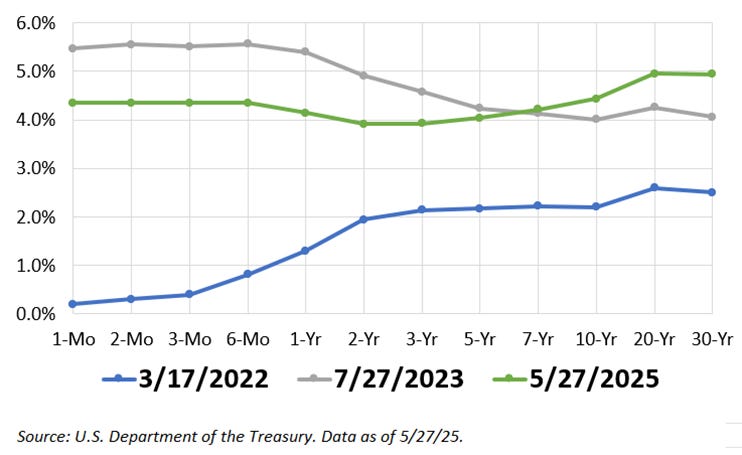

The bond market has been making headlines as of late. Drawing particular attention is the 30-year Treasury bond’s yield. It jumped from a 2025 low of 4.41% on April 4 to 5.08% last week. These were its highest yields since the fall of 2023.

The recent jump in the long bond’s yield has led to “term premium” being increasingly mentioned. The term premium is the extra compensation investors demand for committing funds over a longer period. Investors should expect a term premium since inflation reduces the value of future dollars.

Due to the inverted yield curve (short-term yields higher than long-term yields), term premiums for long-term Treasuries turned into discounts. This has started to change. The rise in rates at the long end of the curve resulted in the 30-year Treasury bond’s yield exceeding the one-year Treasury bill’s yield of 4.14% on Tuesday, May 27.

Treasury Bond Yield Curve

A few factors are being cited for the reemergence of the term premium. One is concerns about rising federal government debt. The tax cuts and extensions included in the One Big Beautiful Bill Act are projected to increase future deficits and, thereby, the national debt. Another factor is fear about the U.S. dollar losing its status as a reserve currency. The U.S. dollar is the least dirty shirt in the closet, with no other currency being a good alternative.

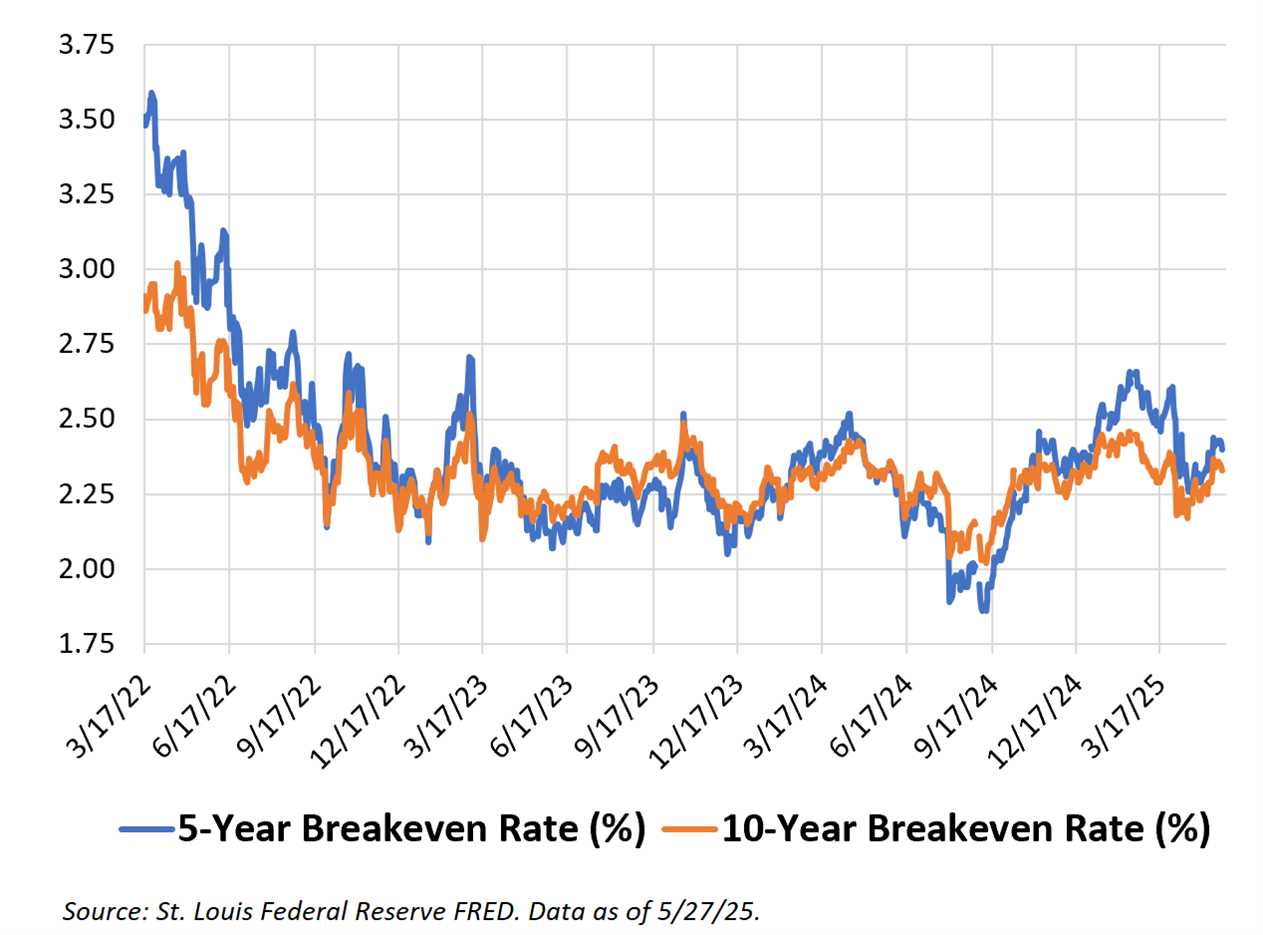

Concerns about future inflation are also being blamed. The bond market has been pricing in higher levels of inflation since last fall. If one steps back and looks at a longer trend, shown in the chart below, breakeven rates are largely within the same trend that began in the fall of 2022.

Breakeven rates signal what bond market participants expect inflation to be in the next five years and the next 10 years. Unlike economic forecasts, these are based on where traders and investors have put their money to work.

The Bond Market’s Inflation Expectations

Getting less attention but still notable are credit spreads. Spreads represent the additional yield investors demand from riskier issuers.

Credit scores provide a good analogy. Borrowers with top-tier credit scores of 781 to 850 will pay lower interest rates for an auto loan than those with lower credit scores.

Credit spreads have widened since President Donald Trump called for reciprocal tariffs in mid-February. A broader view shows this is not currently a reason for worry.

The current spread between corporate bonds with the lowest investment-grade credit ratings (Moody’s Baa) and 10-year Treasury bonds is roughly the same as it was two years ago. Furthermore, credit spreads have exceeded 300 basis points (bps), or 3%, several times over the past 25 years. The spread was 188 bps last Friday.

The Spread Between Treasury and Corporate Bond Yields

All three of these indicators imply bond traders have been pricing in a higher level of risk relative to a few months ago. This change appears to be an adjustment, not an alarm bell.