September Charts of Interest: Rate Cuts, Plus a 3,821% Investment Return

September’s charts highlight a rare S&P 500 winning streak, record equity allocations, covered call ETF trends, and a 3,821% Pokémon card return.

Given yesterday’s interest rate cut announcement by the Federal Reserve, I start this month’s charts of interest by looking at where interest rates could be headed. I then move on to the stock market’s summer rally and portfolio allocations, before ending with the hottest investment over the past few years. (Hint: It’s likely not at all what you are thinking.)

As a reminder, the charts of interest highlights charts and tables I’ve come across that have not made their way into other AAII commentaries but provide insights about the financial markets and the economy.

The Dot Plot Calls for Lower Rates

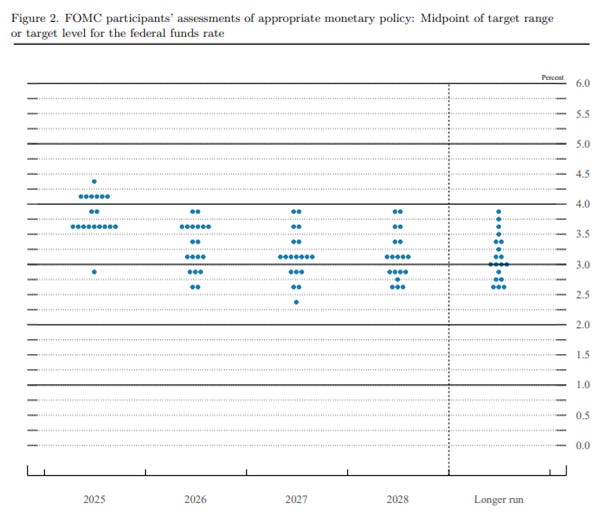

The so-called dot plot shows where Federal Open Market Committee (FOMC) participants project interest rates to be over the next few years. Each dot represents the forecast of a committee member for a given year. The dot plot is updated quarterly.

FOMC members currently expect to make one to two additional quarter-point interest rate cuts this year following yesterday’s 0.25% cut. The lone 2025 dot below 3.0% likely belongs to recent appointee Stephen Miran.

Further interest rate cuts are projected for next year. These forecasts are very much subject to change.

Source: Federal Reserve.

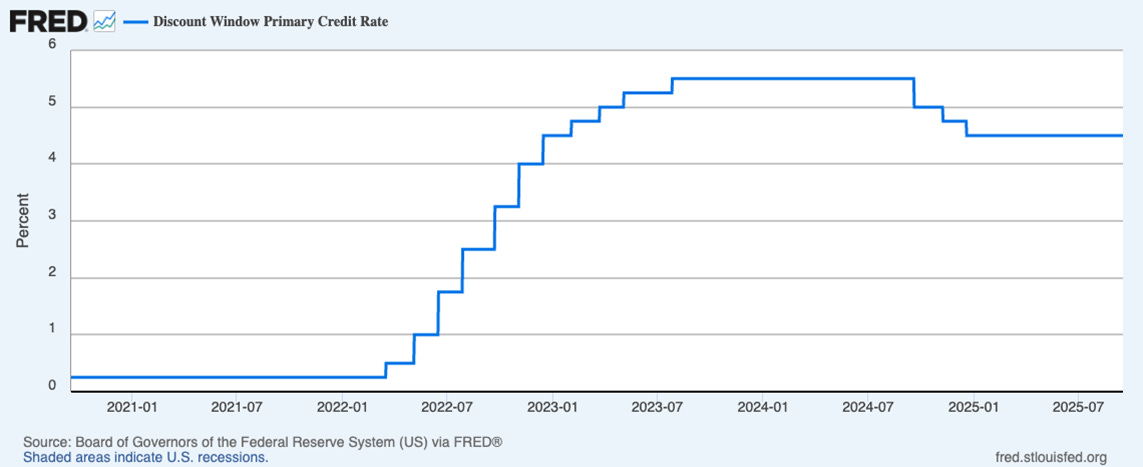

The Discount Rate Was Lowered Too

Less noticed was a decision by Fed governors to lower the discount rate from 4.50% to 4.25%. The discount rate is the interest charged to banks to borrow money from the central bank. Reductions in this rate further signal accommodative monetary policy. (The below chart from the St. Louis Federal Reserve’s FRED database had yet to be updated as of this morning.)

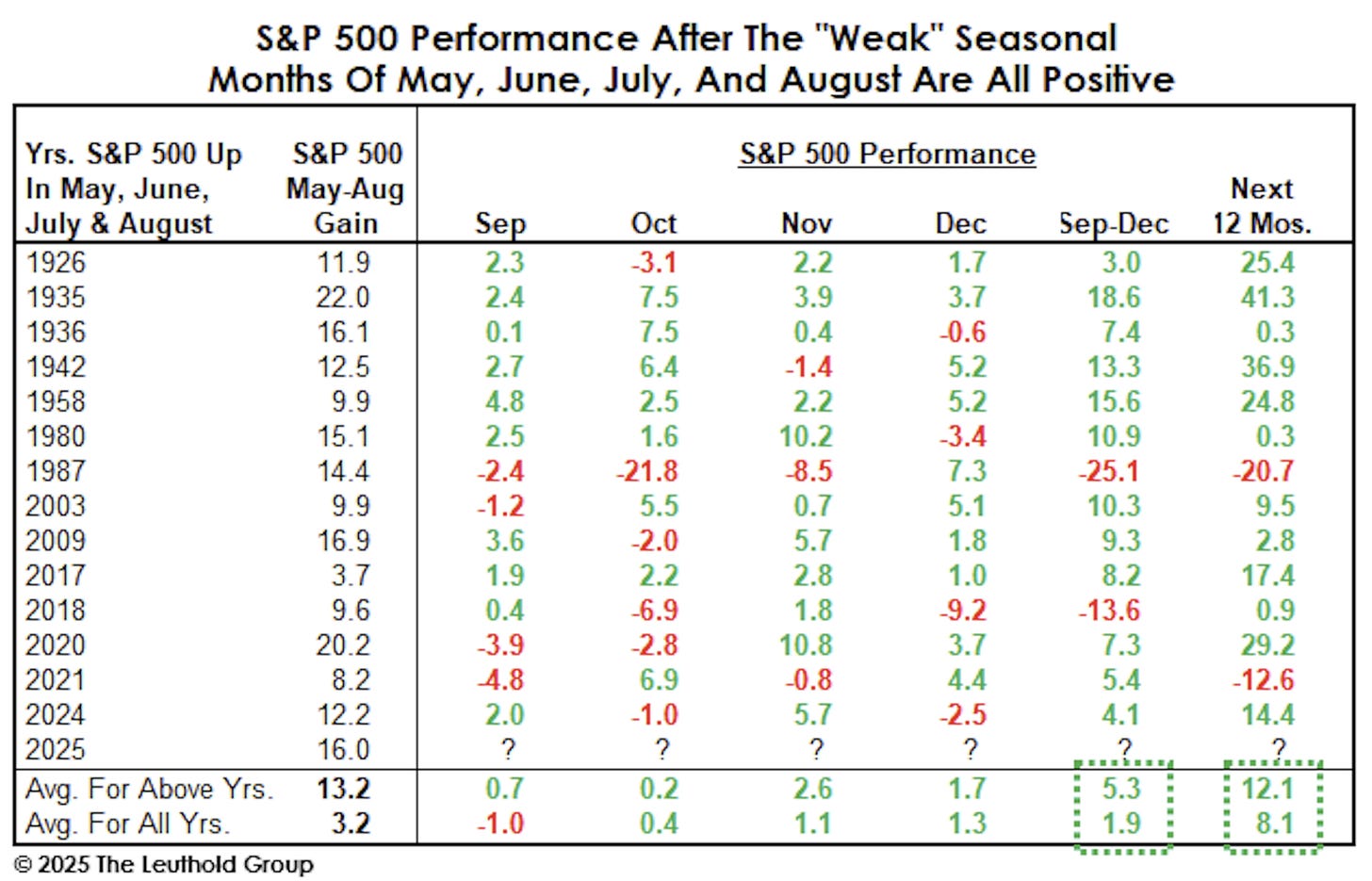

An Infrequent Winning Streak for the S&P 500

The S&P 500 index realized consecutive gains in May, June, July and August. According to Leuthold Group chief investment officer Doug Ramsey, this summer’s winning streak has only happened 14 other times over past 100 years. The winning streak is also notable because May through October has historically been the weakest six-month period for the stock market.

“Since 1926, when all four of these historically weak months have been positive, S&P 500 average performance from September through December has been +5.3%—a figure marred by both the 1987 crash and the late-2018 market falloff,” stated Ramsey.

The sample size is small, and history is never guaranteed to repeat. Nonetheless, it is nice to have the odds in our favor.

Institutional Investor Equity Allocations at a 28-Year High

Institutional investors’ exposure to equities is at its highest level since November 2007, according to State Street.

Record high prices for U.S. stock markets have boosted the value of equities, while the lack of a meaningful pullback in yields has capped returns for bonds. Both of these factors plus institutional investor preferences play a role in current allocations.

Source: State Street Markets and Daily Chartbook.

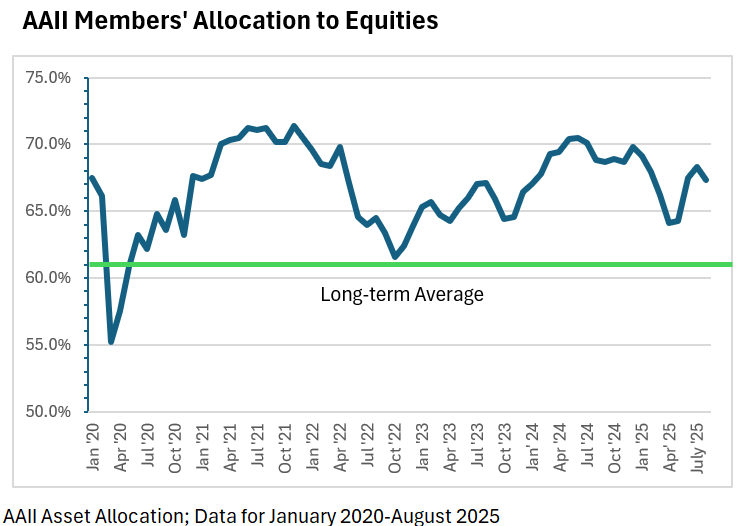

I’ll add that equity exposure among AAII members continues to stay above the long-term average of 62.0% in the AAII Asset Allocation Survey. Stock and stock fund allocations were 67.3% last month.

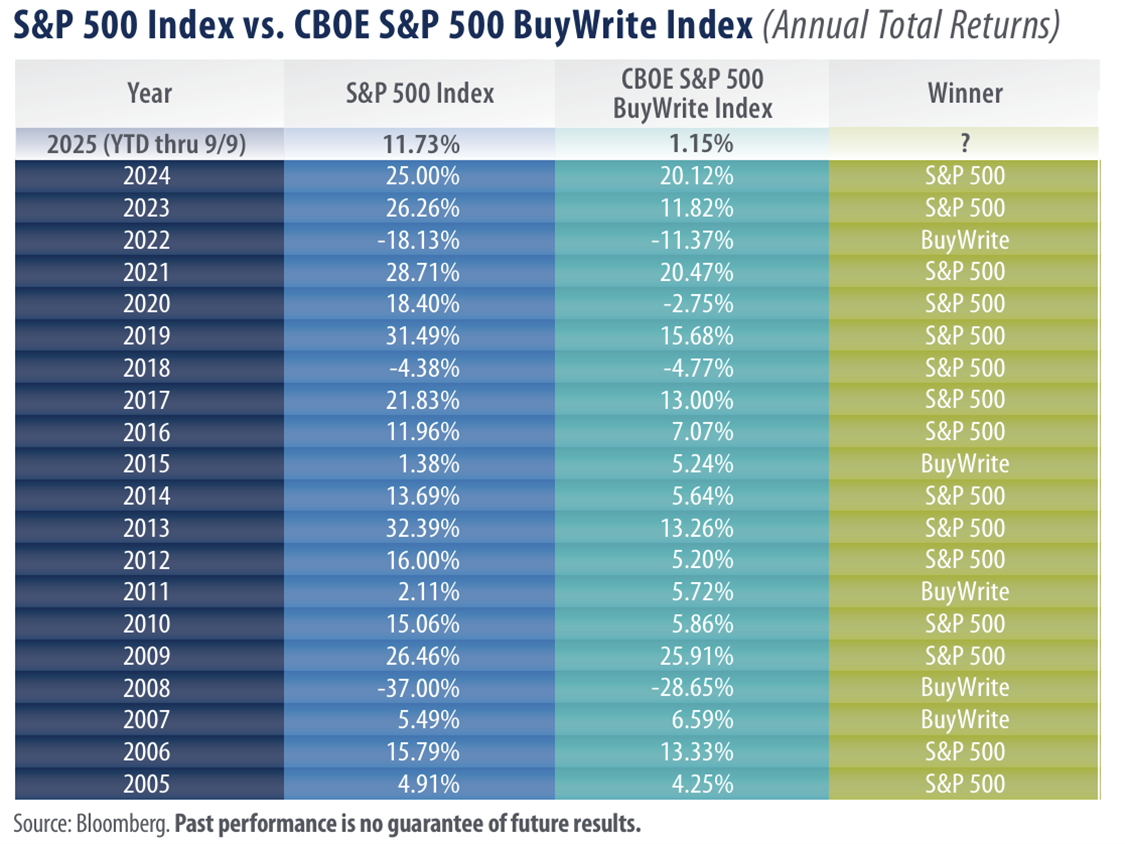

Covered Call Strategies Lag in Good Market Conditions

Exchange-traded funds (ETFs) using options strategies have been growing in popularity. Among the options strategies used are covered calls. Covered call strategies involve selling (“writing”) call options on stocks held in a portfolio. The goal for the call writer (seller) is to have the option contract expire unexercised. This allows them to realize extra income without selling the underlying stock.

The return data shows that these strategies have not been as attractive as their proponents may suggest. Return data published by Robert Carey and Peter Leonteos of First Trust shows the S&P 500 outperforming the CBOE S&P 500 BuyWrite index during 15 out of the last 20 years.

Covered call strategies have historically lagged when the S&P 500’s returns have been above 10% in a calendar year. This is likely because covered call strategies limit upside returns. The long-term average return for large-cap stocks is 12.3%.

Covered call strategies do outperform “when the stock market posts negative returns, or when returns range from 0%–10%,” explained Carey and Leonteos. Good luck trying to predict those years in advance.

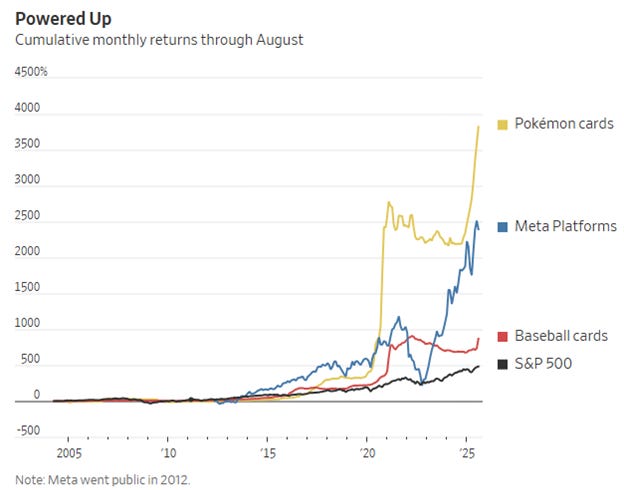

The Hottest Investment Is …

Pokémon cards have realized a 3,821% monthly cumulative return since 2004, according to The Wall Street Journal’s report based on data from analytics firm Card Ladder. Cards of the fantasy game’s characters saw their prices jump during the coronavirus pandemic. Prices rose further after an influencer purchased a card for $5.3 million in 2022.

As is the case with baseball and other sports-related cards, rarity and condition matter. More importantly, demand can change faster than a Pokémon can use one of their special powers.

Source: The Wall Street Journal, Card Ladder and FactSet.