Options for Your Cash as More Fed Rate Cuts Are Likely

See how average savings account rates compare in 2025. Learn cash holding rules and find higher yields with CDs, money markets and online banks.

The interest paid on cash savings accounts, certificates of deposit (CDs), money market accounts and other cash equivalents will fall further given current expectations for monetary policy. The CME FedWatch Tool shows that traders are pricing in a high possibility of interest rates being lowered at both the October and December Federal Open Market Committee (FOMC) meetings.

Such cuts would add to the reduction in interest rates that has already occurred. Interest rates are currently lower than they were in late 2023 and early 2024.

If you are trying to decide what to do with your cash allocations now, start by being clear about the rationale for your current allocation to cash. Maintaining adequate emergency savings is prudent since it provides you with liquidity when you need it most.

If you increased your cash allocations to take advantage of the previous higher interest rates, take a moment to reassess. Cash-equivalent vehicles have generated a lower level of returns relative to stocks or bonds over the long term. Cash allocations also lose purchasing power over time. This results in being able to buy fewer goods and services with the dollars you have.

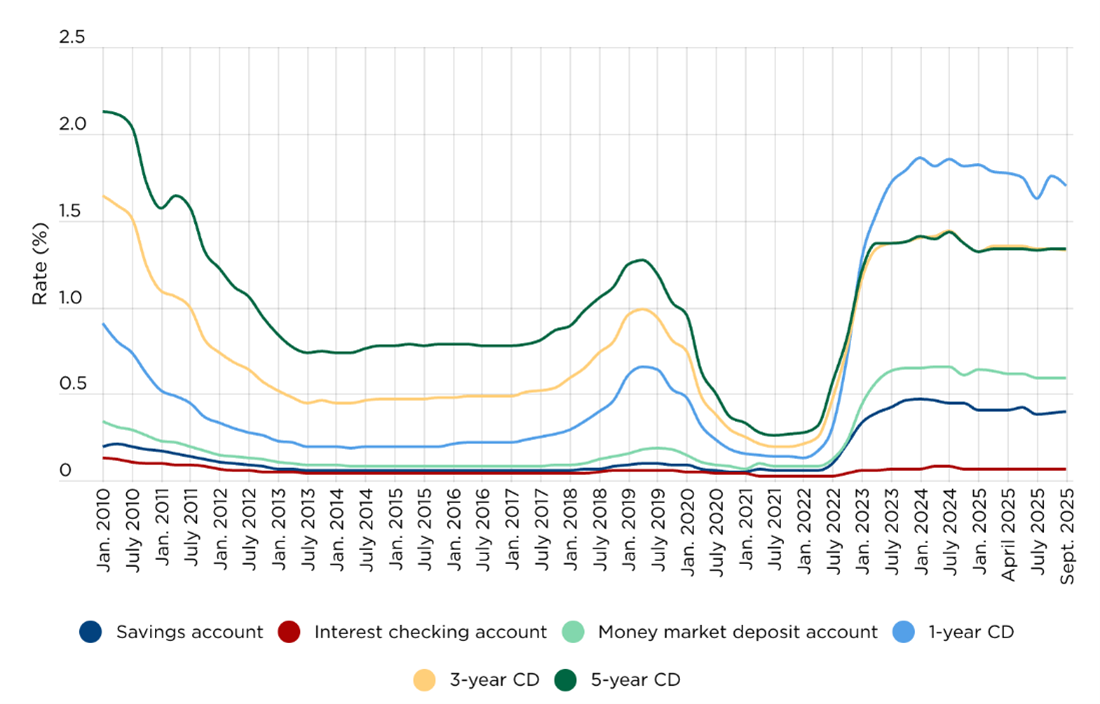

National Average Interest Rates Paid on Savings

Source: NerdWallet and the Federal Deposit Insurance Corp. Data as of September 2025.

How much cash should you hold onto? It depends on your needs. There are two useful rules of thumb: Those who are working should hold enough cash for six months’ to one year’s worth of expenses, and those nearing or in retirement should hold enough cash for two to four years’ worth of planned withdrawals. Amounts needed to cover other large expenditures within the next few years should also be maintained in cash. Beyond that, long-term investors should put their cash to work in assets with higher levels of potential return, such as stocks.

Given all this, let’s look at your options for where to hold your cash.

Traditional checking accounts and brokerage sweep accounts often pay relatively little interest. The chart above from NerdWallet shows the national average paid on interest-bearing checking accounts to be a paltry 0.07%. Savings accounts aren’t much better with an average interest rate of just 0.40%. One-year CDs are better at 1.70%, but they still don’t pay much.

Shopping around and banking online will get you better interest rates. As of yesterday, Bankrate listed several banks and credit unions paying interest rates of between 4.20% and 4.35% on savings accounts. Five-year CDs are yielding around 3.70% to 3.91%. Always make sure the account is insured by the Federal Deposit Insurance Corp. (FDIC) for banks or the National Credit Union Administration (NCUA) for credit unions. Not all savings accounts or CDs are.

Money market funds are another option. The Vanguard Federal Money Market fund (VMFXX), for instance, yielded 4.1% yesterday. Pay attention to the expense ratio when considering a money market fund, especially given the current yield environment.

Don’t ignore your brokerage accounts. Cash allocated to the default sweep account is probably earning very little interest. That’s fine if you want to trade on a moment’s notice, but it’s not good if you are just leaving it there. Your broker may offer better-paying alternatives. You could also move the dollars to a money market account.

Ultra short-term bond funds are an option, but you will encounter some price volatility by holding them. It is the same with actual short-term notes (e.g., Treasury notes and bills). I suggest comparing their yields to what is offered by money market accounts. You want to ensure that the extra yield is enough to compensate you for the volatility in those funds’ share prices.

AAII Sentiment Survey: September 25, 2025 Update

Pessimism among individual investors about the short-term outlook for stocks decreased in the latest AAII Sentiment Survey. Meanwhile, optimism increased slightly and neutral sentiment decreased.

Bullish sentiment, expectations that stock prices will rise over the next six months, increased 0.1 percentage points to 41.7%. Bullish sentiment is above its historical average of 37.5% for the second time in eight weeks.

Neutral sentiment, expectations that stock prices will stay essentially unchanged over the next six months, increased 3.1 percentage points to 19.1%. Neutral sentiment is unusually low and is below its historical average of 31.5% for the 62nd time in 64 weeks.

Bearish sentiment, expectations that stock prices will fall over the next six months, decreased 3.2 percentage points to 39.2%. Bearish sentiment is above its historical average of 31.0% for the 43rd time in 45 weeks.

The bull-bear spread (bullish minus bearish sentiment) increased 3.2 percentage points to 2.5%. The bull-bear spread is below its historical average of 6.5% for the 32nd time in 34 weeks.

This week’s special question asked AAII members what they think about the Federal Reserve’s decision to cut interest rates by 0.25 percentage points.

Here is how they responded:

It was the right move: 49.8%

They should have cut rates by more percentage points: 27.0%

They should have left it unchanged: 17.5%

They should have raised rates: 2.1%

Not sure/no opinion: 3.2%

This week’s Sentiment Survey results:

Bullish: 41.7%, up 0.1 points

Neutral: 19.1%, up 3.1 points

Bearish: 39.2%, down 3.2 points

Historical averages:

Bullish: 37.5%

Neutral: 31.5%

Bearish: 31.0%

See more Sentiment Survey results.