October Charts of Interest: Happy Birthday, Bull Market!

The bull market turns three as the S&P 500 rises 87% since 2022. See key market trends and holiday spending insights.

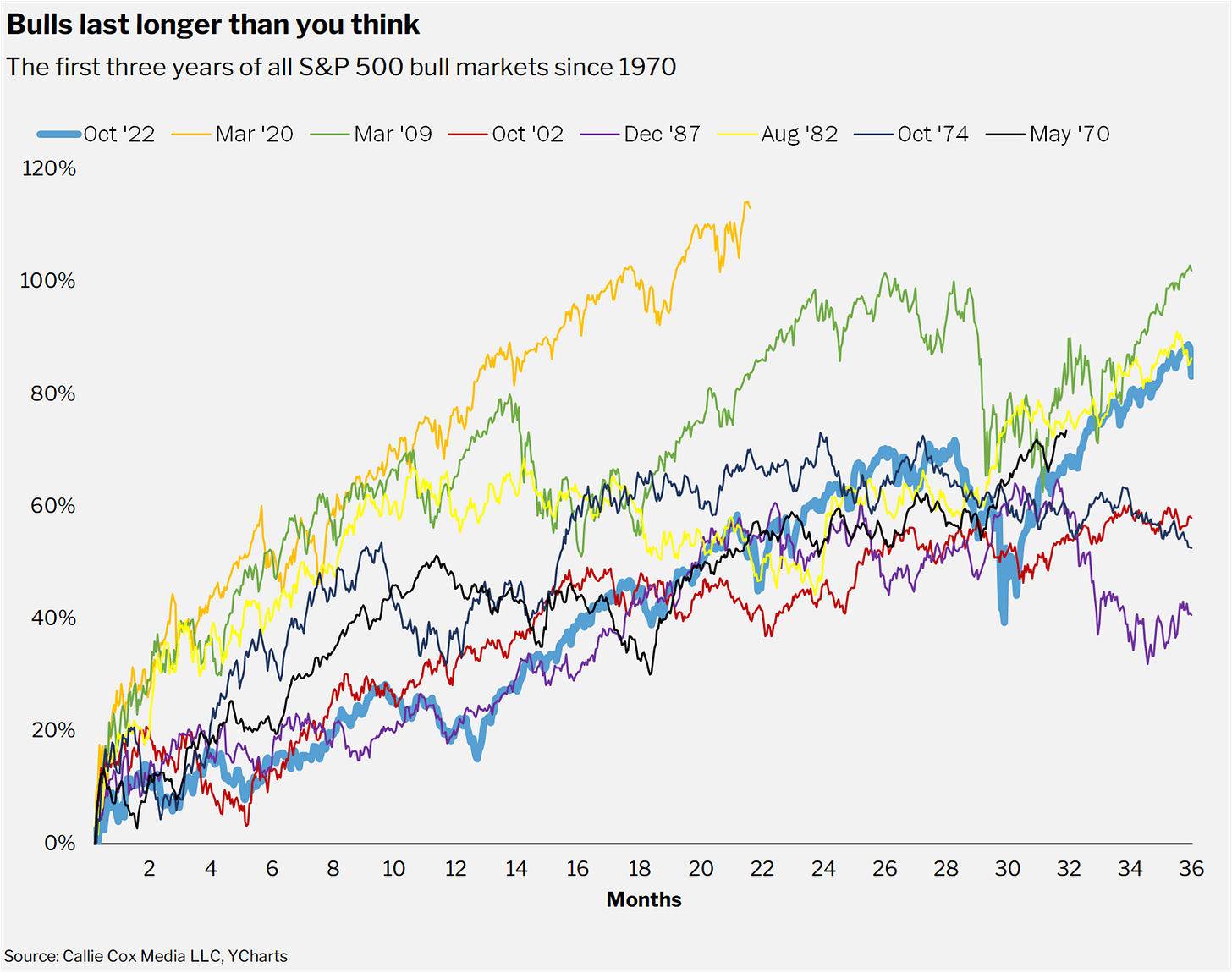

Last week, the current bull market turned three years old. In this month’s charts of interest, I show you how the market’s current rally compares to past bull markets and share a few reasons to remain allocated to stocks. I then look at a few market trends that are occurring below the surface, before ending with a preview of the holiday shopping season. Yes, that time of year is coming.

The Bull Market Is Above Average

The S&P 500 index’s 87% gain since October 2022 is above average relative to all bull markets since 1970. However, it is hardly top tier, as this chart from Callie Cox shows.

Notably, most bull markets that have made it to year three have celebrated their fourth birthday. Past performance is no guarantee of future returns, but the Federal Reserve is in an accommodative stance. Who knows? Maybe we’ll even get a trade deal with China. (Yes, the key word is “maybe.”)

Economic News Sentiment Could Favor the Bulls

A high frequency measure of economic sentiment—the San Francisco Federal Reserve’s Daily News Sentiment Index (DNSI)—is currently lower than 81% of all readings since 1980. “When pessimism about the economy gets as sour as it is today, usually the stock market has performed remarkably well,” wrote retired market strategist Jim Paulsen on his Substack.

The DNSI provides economic news sentiment scores dating back to 1980. It constructs sentiment scores for economics-related news by analyzing articles from 24 major U.S. newspapers.

It Pays to Stay When the Market Is at All-Time Highs

This table from Schroders illustrates the advantage of staying invested when the market is trading at an all-time high. The footnote accompanying the table said, “Data January 1926–December 2024. Switching strategy moves into cash for the next month whenever the previous month-end was an all-time high and is invested in stocks whenever it wasn’t.”

Source: Schroders.

Is Small-Cap Value Starting to Heat Up?

Over the past three months, the iShares Russell 2000 Value ETF (IWN) has outperformed the iShares Core S&P 500 ETF (IVV). Three months is not enough time to declare a shift in trends, but small-cap value remains historically undervalued relative to large-cap stocks.

Source: QuoteMedia and AAII.com. Data as of 10/17/2025.

10 Companies Account for 40% of the S&P 500

Just 10 of the 500 companies within the S&P 500 account for 40.4% of the index’s market capitalization. This is an extremely high number.

Source: J.P. Morgan Asset Management. Data as of 9/30/2025.

Fewer Than Half of the S&P 500 Stocks Are Beating the Index

Just 44% of the S&P 500’s member stocks outperformed the index during the first half of 2025. This below-average level has made it harder for large-cap stock-pickers to outperform. It also explains why strategies that don’t target the so-called Magnificent Seven technology stocks are underperforming.

This Is Not Sustainable

One more chart from Schroders. Nasdaq composite companies with no revenues have realized the highest year-to-date price returns through September 30, 2025. Ranking in third and fourth place were unprofitable companies.

Revenues and earnings matter. Stocks of companies with no revenues implode. Unprofitable companies see their share prices suffer if they are unable to turn their business around. While there are some exceptions to these rules, they are a tiny minority.

Source: Schroders.

Shoppers to Cap Spending This Holiday Season?

Since there are just 62 shopping days left until Christmas (52 days until Hanukkah), let’s get an early read on consumer spending plans.

“Most shoppers who typically buy holiday gifts (74%) said they plan to spend the same as they usually do, or less, this year,” a Morning Consult survey found. “Those who said they’re spending more are planning to buy more gifts (42%) and say they will give gifts to more people (35%), so their per-gift costs aren’t necessarily increasing as much as the size of their overall shopping list.”