November Charts of Interest: The S&P 500 Tends to Finish Strong

Discover why December often boosts stocks, where foreign value stocks shine, how tech giants’ borrowing is reshaping markets, and why turkey prices are soaring.

December is right around the corner, and it has historically been a good month for stocks. This month’s charts of interest looks at the presents the stock market has given investors, before turning toward valuations. We then pivot to the bond market and the heavy borrowing and spending by technology companies. Since Thanksgiving is next week, we talk some turkey (prices) too.

December Has Been Good for Stocks

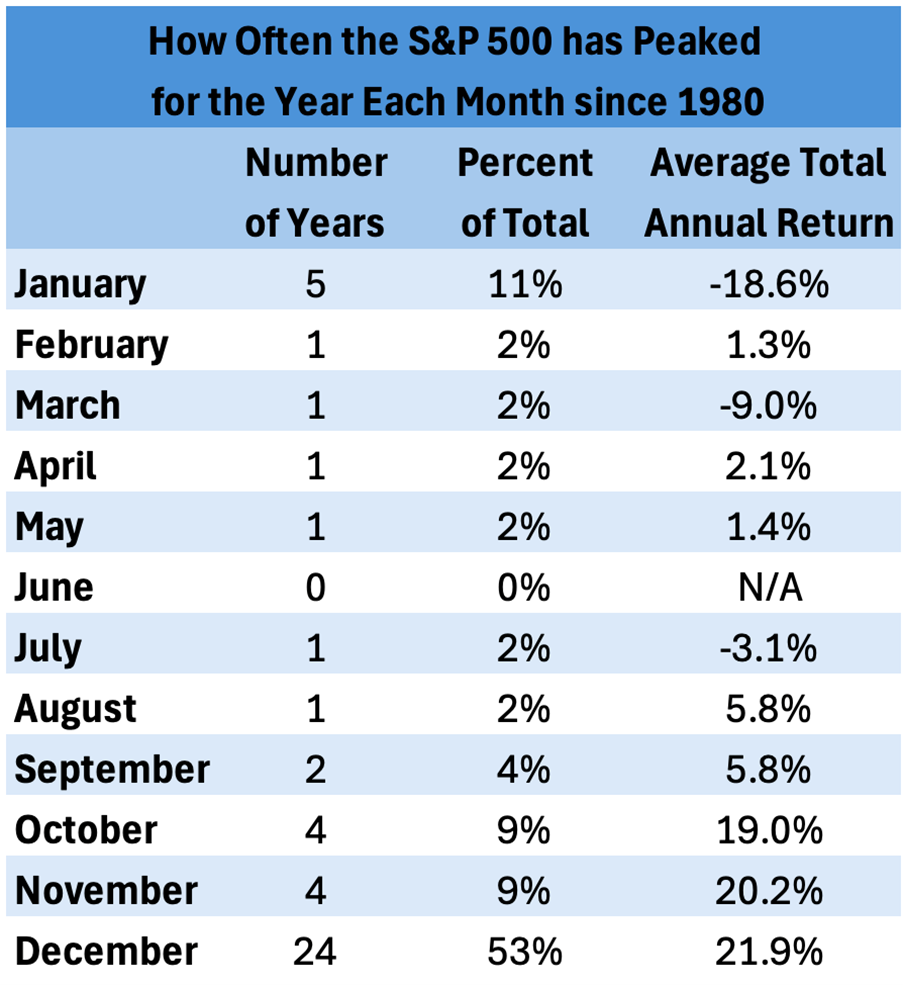

December has done more than bring gifts to the good boys and girls; it has also tended to grow investors’ wealth. According to DataTrek, the S&P 500 index “has peaked for the year in December over half the time back to 1980 (53%, 24 out of 45 years). The average annual return during the years when the S&P 500 peaked in December was 21.9%.”

The last month of the year has historically been among the better months in terms of average returns and frequency of advances. Still, there is no guarantee of whether returns will be positive or negative next month.

What I can tell you with certainty is that the S&P 500 would need a big year-end run to hit that 21.9% mark. As of yesterday, the index’s year-to-date return was a still-good 12.9%.

Source: DataTrek.

Foreign Stocks Are Cheap, Especially Foreign Value Stocks

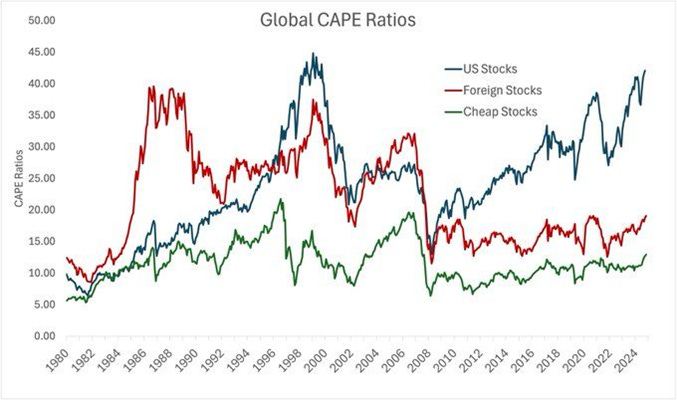

The valuation spread between U.S. stocks and foreign stocks remains very wide. Investors who like deep value may want to look at foreign value stocks, which trade at an even bigger discount. Cambria Investments’ Meb Faber recently posted that these stocks, designated by the green line in the chart below, are trading at a cyclically adjusted price-earnings (CAPE) ratio of just 13.

Source: Meb Faber.

The Yield Spread Is Historically Low

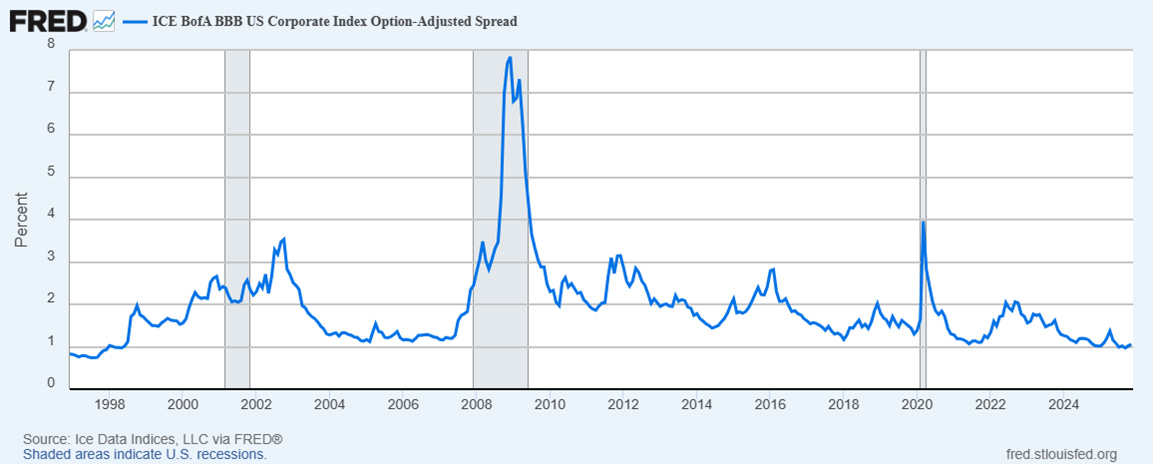

The spread (difference) between the higher yields paid on investment-grade corporate bonds and U.S. government bonds was just 1.06 percentage points on Monday. This is among the tightest spreads seen since the late 1990s. According to The Wall Street Journal, demand from insurers for corporate debt is among the factors playing a role.

The Tech Giants Have Become Big Borrowers

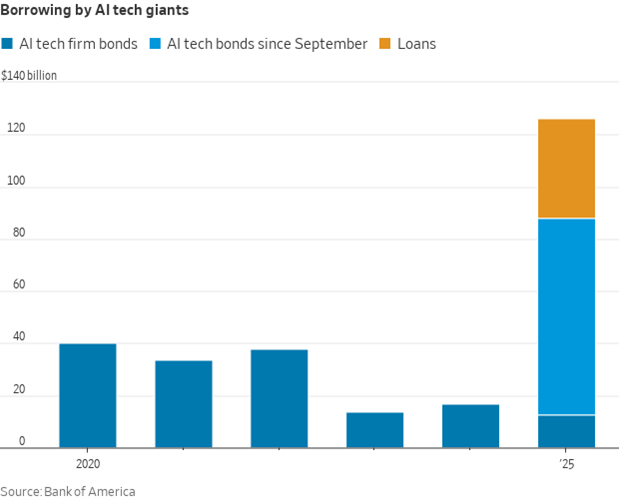

Artificial intelligence (AI) does not come cheap, and the largest technology companies have been turning to the bond markets to help finance it. The Wall Street Journal’s Jason Zweig noted in his Intelligent Investor column that “between September 1 and November 13—less than three months—big tech companies issued more bonds than they had in the previous three calendar years combined.”

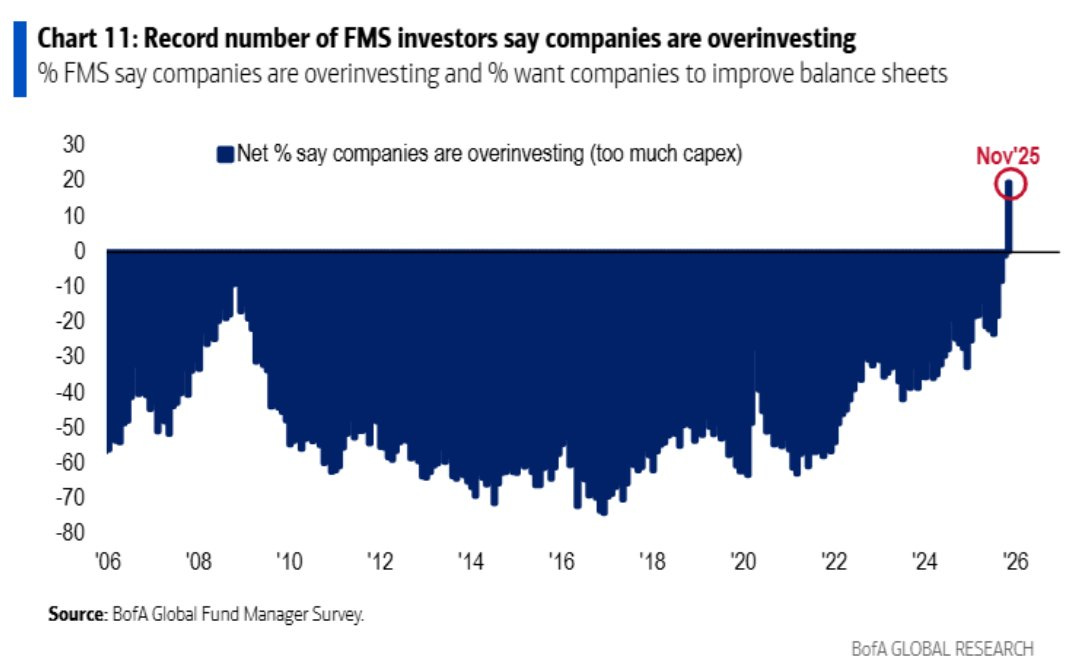

Fund Managers Think Tech Companies Are Overinvesting

This borrowing binge hasn’t gone unnoticed. A recent BofA Global Research chart tweeted by Barchart shows a net positive amount of fund managers saying that technology companies are overinvesting.

“As God Is My Witness, I Thought Turkeys Could Fly”

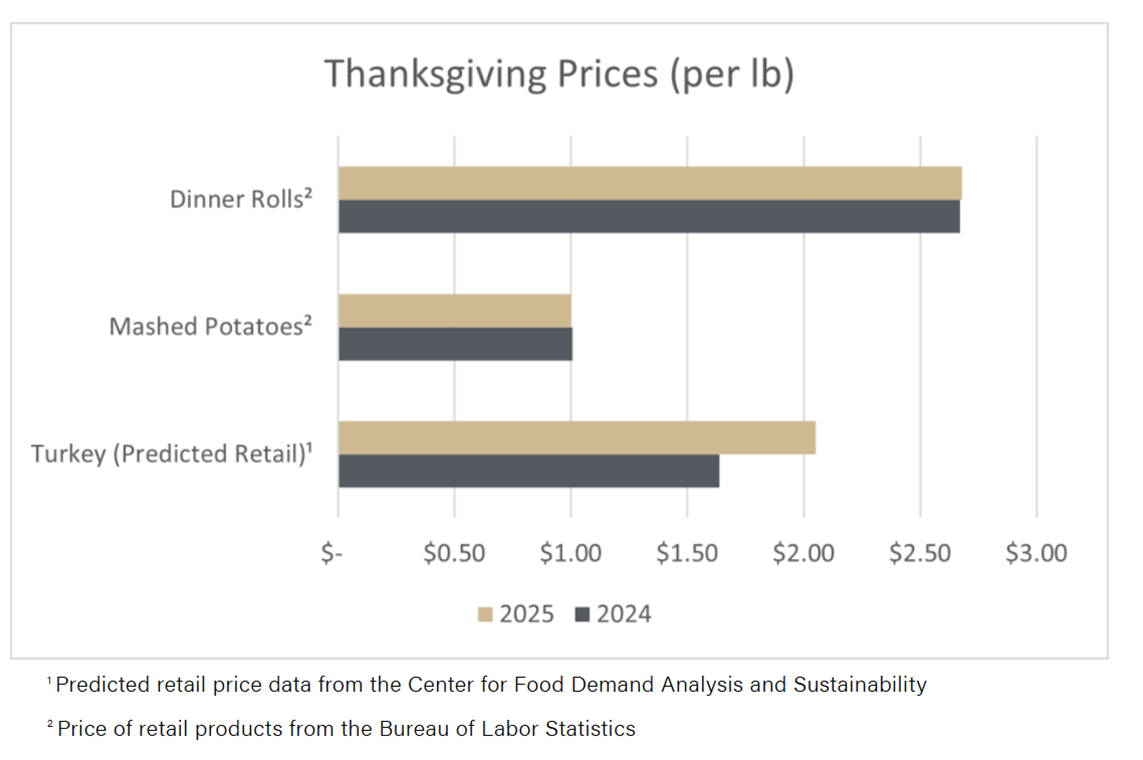

Turkeys aren’t known for their ability to fly (which made for a very funny episode of “WKRP in Cincinnati”), but their prices have taken flight. “Wholesale turkey prices have surged 75% since October 2024, reaching $1.71 per pound in October 2025,” wrote Caitlinn Hubbell and Elijah Bryant of Purdue University’s College of Agriculture. Avian flu is mainly to blame.

Depending on where you shop, the price increase may not show at the register. This is due to the willingness of some stores to use turkey as a loss leader to attract shoppers.

Source: Purdue University, Center for Food Demand Analysis & Sustainability blog, 10/29/2025.