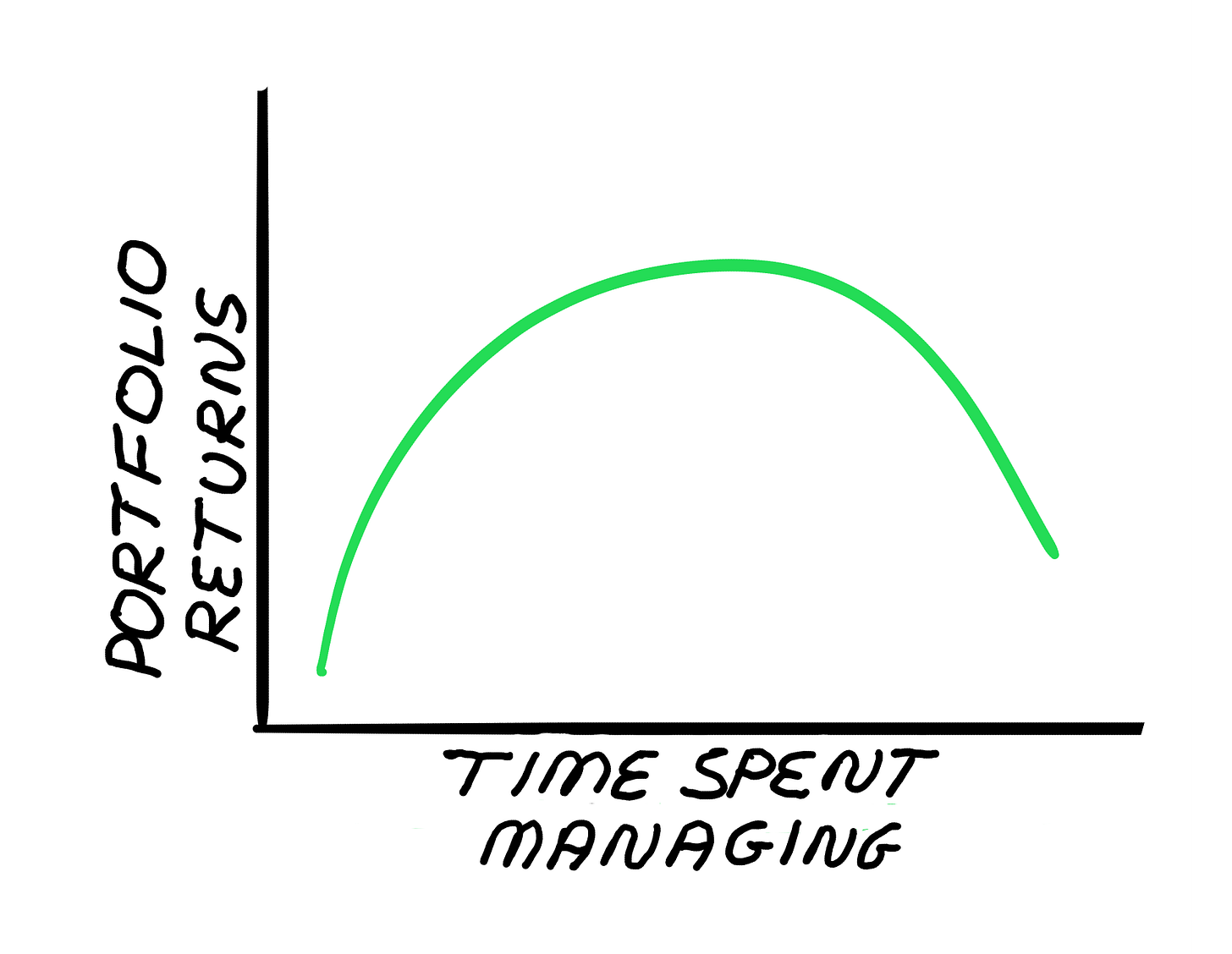

More Time Spent on Your Portfolio Can Worsen Returns

More time managing your portfolio can hurt returns. Learn why a disciplined, evidence-based approach outperforms constant trading and analysis.

Having more time to manage your portfolio doesn’t lead to better results. In fact, it may lead to worse outcomes.

Yes, setting aside more time gives you more opportunities to research companies, analyze financial statements and carefully weigh investment options. However, none of this is the same as having a disciplined, evidence-based process that you routinely follow.

A study conducted by researchers from Umeå University in Sweden demonstrated this. They tracked 59,105 individual investors for five years—two years before retirement and three years after retirement. Detailed portfolio data from the Swedish Tax Agency was used to analyze how those investors performed.

Returns worsened after retirement, when those investors had more time to analyze investments. Risk-adjusted alpha fell 0.6 percentage points after retirement. For combined stock and mutual fund portfolios, alpha fell 0.5 percentage points. (Alpha is the additional return attributed to an investor’s decisions.)

These decreases in alpha may not seem significant until you realize that the investors tracked, as a group, were already underperforming. Prior to retirement, their average portfolios were underperforming by 3% to 4% annually. The extra time spent managing their portfolios made matters worse. The Swedish study illustrates the law of diminishing returns in action: Beyond a certain point, additional time spent on portfolio management becomes counterproductive.

One cause of the worsened performance was increased trading activity. Annual trading frequency was up 7.7% after retirement, adding about one-quarter of a trade per year. The number of stocks held in portfolios also increased, from an average of 5.5 stocks before retirement to 6.3 stocks after retirement. There was also greater variation in behavior after retirement, as some retirees became substantially more active traders.

Increasing the time spent researching stocks makes intuitive sense. Time constraints during working years create a barrier to processing investment information. Remove that barrier by retiring, and investors have more time and energy to devote to their portfolios.

While this might seem like an advantage, it’s disadvantageous if it causes a person to stray from a disciplined process. It is even more dangerous if one doesn’t have a good, repeatable process before increasing the amount of time spent analyzing investments.

So how much time should disciplined investors spend managing their portfolios?

The range of time a disciplined investor needs to spend on their portfolio starts at just a few minutes per year. A passive investor holding exchange-traded funds (ETFs) or mutual funds that track well-known indexes will only need to periodically check their statements, ensure their portfolio allocation is close to their target and take any needed withdrawals [e.g., required minimum distributions (RMDs)].

Investors holding individual stocks should monitor quarterly earnings reports. A weekly or monthly check of your portfolio will allow you to catch any important news or events. Pay attention to any changes that might cause a stock to violate a predefined sell rule, such as a high valuation.

If you prefer to check your portfolio daily, consider doing so after the U.S. markets have closed so you have a cooling off period before acting on any emotions.

Only those engaging in trading or other active strategies need look at their portfolio more frequently. Even then, you should follow a disciplined process governing what you will look at and what decisions you will make.

Investor Update Archives

October 2, 2025 Mutual Funds to Gain ETF Tax Advantages and Intraday Trading

September 25, 2025 Options for Your Cash as More Fed Rate Cuts Are Likely

September 18, 2025 September Charts of Interest: Rate Cuts, Plus a 3,821% Investment Return

September 11, 2025 Muni Bond Funds’ Additional Advantage