Measuring Three Homebuilder Stocks

Discover how D.R. Horton, PulteGroup and Taylor Morrison score with AAII’s A+ Stock Grades. With rising demand, earnings beats and easing rates, are homebuilder stocks poised for more growth?

This week, we use AAII’s A+ Investor Stock Grades to provide insight into three homebuilder stocks. With steady home price growth projected, ongoing demand for new construction and recent earnings beats across the industry, should you consider the three stocks of D.R. Horton Inc. (DHI), PulteGroup Inc. (PHM) and Taylor Morrison Home Corp. (TMHC)?

Homebuilder Stocks Recent News

Earlier this year, U.S. home prices were projected to rise 3% during the year, according to J.P. Morgan Research, supported by a growing supply of new homes and a gradual easing of mortgage rates by year-end.

More recently, several key indicators point to growing investor confidence in the industry. According to Bloomberg Intelligence, an index tracking U.S. homebuilders jumped 16.0% in August, significantly outperforming the S&P 500 index’s 2.3% gain and marking the industry’s best month since July 2024. The rebound is attributed to expectations of falling interest rates, which could further boost affordability and housing demand. Limited resale inventory has pushed more buyers toward new construction, while builders have responded with competitive pricing, smaller entry-level offerings and incentives such as mortgage-rate buydowns to sustain sales momentum.

D.R. Horton, PulteGroup and Taylor Morrison are all active players that may benefit from these trends. The companies recently reported better-than-expected quarterly earnings, reflecting strong execution and rising demand. D.R. Horton posted earnings of $3.36 per share, which was 15.8% higher than the S&P Global consensus estimate; PulteGroup reported earnings of $3.03 per share, a 3.3% positive surprise; and Taylor Morrison delivered earnings of $1.92 per share, 3.2% higher year over year. As interest rates ease and home affordability improves, these three homebuilders may be well-positioned to capture further market share for the rest of 2025 and beyond.

Sign Up to Receive a Free Special Report That Shows How A+ Investor Grades Can Help You Make Investment Decisions

Grading Homebuilding Stocks With AAII’s A+ Stock Grades

When analyzing a company, it is helpful to have an objective framework that allows you to compare companies in the same way. This is why AAII created the A+ Stock Grades, which evaluate companies across five factors that research and real-world investment results indicate to identify market-beating stocks in the long run: value, growth, momentum, earnings estimate revisions (and surprises) and quality.

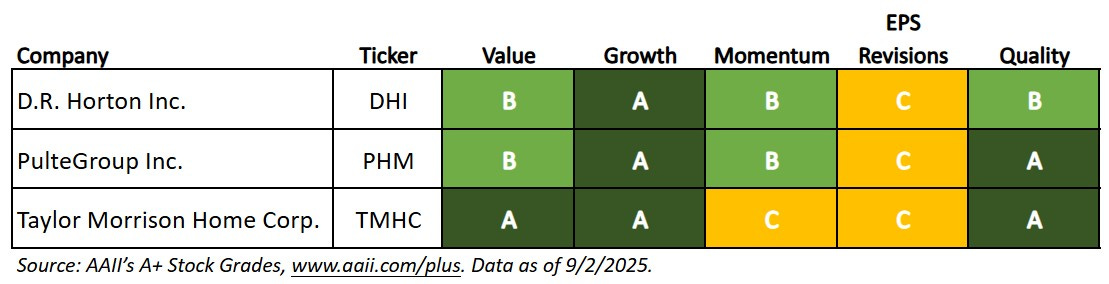

Using AAII’s A+ Stock Grades, the following table summarizes the attractiveness of three homebuilding stocks—D.R Horton, PulteGroup and Taylor Morrison—based on their fundamentals.

AAII’s A+ Stock Grade Summary for Three Homebuilding Stocks

What the A+ Stock Grades Reveal

D.R. Horton Inc. (DHI) operates as a homebuilding company in the East, North, Southeast, South Central, Southwest and Northwest regions of the U.S. It engages in the acquisition and development of land, as well as the construction and sale of residential homes in 125 markets across 36 states under the D.R. Horton name. The company constructs and sells single-family detached homes and attached homes, such as townhomes, duplexes and triplexes. It provides mortgage financing services, title insurance policies, and examination and closing services. It also engages in the residential lot development business. In addition, the company develops, constructs, owns, leases and sells multifamily and single-family rental properties and owns nonresidential real estate, including ranch land and improvements. It primarily serves homebuyers. D.R. Horton was founded in 1978 and is headquartered in Arlington, Texas.

D.R. Horton has a Momentum Grade of B, based on its Momentum Score of 69. This means that the stock’s momentum has been strong in terms of its weighted relative price strength over the last four quarters. The weighted four-quarter relative strength rank is the relative price change for each of the past four quarters, with the most recent quarterly price change given a weight of 40% and each of the three previous quarters given a weight of 20%. The ranks are 89, 37, 21 and 28, sequentially from the most recent quarter. The weighted four-quarter relative price strength is 4.1%.

A higher-quality stock possesses traits associated with upside potential and reduced downside risk. Backtesting of the Quality Grade shows that stocks with higher grades, on average, outperformed stocks with lower grades from 1998 through 2019.

The A+ Quality Grade is the percentile rank of the average of the percentile ranks of return on assets (ROA), return on invested capital (ROIC), gross income to assets, buyback yield, change in total liabilities to assets, accruals to assets, Z double prime bankruptcy risk (Z) score and F-Score. The score is variable, meaning it can consider all eight measures or, should any of the eight measures not be valid, the valid remaining measures. To be assigned a Quality Score, though, stocks must have a valid (non-null) measure and corresponding ranking for at least four of the eight quality measures.

D.R. Horton has a Quality Grade of B, based on a score of 73, which is strong. The company ranks strongly in terms of its return on assets and Z-Score. Its return on assets of 11.1% ranks in the 90th percentile among all U.S.-listed stocks, and its Z-Score of 14.50 ranks in the 95th percentile. D.R. Horton also has an F-Score of 4, which is below the sector median of 5 and ranks in the 36th percentile. The F-Score is a number between 0 and 9 that assesses the strength of a company’s financial position. It considers the profitability, leverage, liquidity and operating efficiency of a company.

The components of the Growth Composite Score consider a company’s success in growing sales on a year-over-year and long-term annualized basis and its ability to consistently generate positive cash from its core operations. The company’s Growth Grade is A, which is very strong. D.R. Horton has generated positive annual cash from operations in the past five consecutive years and has a five-year annualized sales growth rate of 15.9%.

PulteGroup Inc. (PHM), through its subsidiaries, engages in the U.S. homebuilding business. It acquires and develops land primarily for residential purposes and constructs housing on such land. The company offers various home designs, including single-family detached homes, townhomes, condominiums and duplexes under the Centex Homes, Pulte Homes, Del Webb, DiVosta Homes, John Wieland Homes and Neighborhoods, and American West brand names. In addition, the company arranges financing through the origination of mortgage loans for homebuyers; sells the servicing rights for the originated loans; and provides title insurance policies and examination and closing services to homebuyers. PulteGroup was founded in 1950 and is headquartered in Atlanta, Georgia.

PulteGroup has a Value Grade of B, based on its Value Score of 78, which is good value. The Value Grade is the percentile rank of the average of the percentile ranks of the price-to-sales (P/S) ratio, price-earnings (P/E) ratio, price-to-book-value (P/B) ratio, price-to-free-cash-flow (P/FCF) ratio, shareholder yield and the ratio of enterprise value to earnings before interest, taxes, depreciation and amortization (EBITDA).

The company has a price-earnings ratio of 9.9, ranking in the 16th percentile. Its enterprise-value-to-EBITDA ratio is 6.9 and its shareholder yield is 5.6%, ranking in the 18th and 13th percentiles, respectively. The price-to-sales ratio of 1.53 ranks in the 42nd percentile.

Earnings estimate revisions indicate how analysts view a firm’s short-term prospects. PulteGroup has an Earnings Estimate Revisions Grade of C, based on a score of 46, which is neutral. The grade is based on the statistical significance of its latest two quarterly earnings surprises and the percentage change in its consensus estimate for the current fiscal year over the past month and past three months.

PulteGroup reported a positive earnings surprise of 3.3% for the second quarter of 2025, and in the prior quarter reported a positive earnings surprise of 5.2%. Over the last three months, the consensus earnings estimate for the third quarter of 2025 has decreased from $2.920 to $2.882 per share. The consensus earnings estimate for full-year 2025 has decreased from $11.448 to 11.365 per share.

PulteGroup has a Growth Grade of A, which is very strong. The company ranks in the 80th percentile for its five-year annualized sales growth rate of 11.9%.

Taylor Morrison Home Corp. (TMHC), together with its subsidiaries, operates as a land developer and homebuilder in the U.S. It designs, builds and sells single-family and multifamily detached and attached homes and develops lifestyle and master-planned communities. The company also develops and constructs multiuse properties comprising commercial space, retail and multifamily properties under the Urban Form brand name. In addition, it offers financial, title insurance and closing settlement services. Further, the company engages in the build-to-rent homebuilding business under the Yardly brand name. It operates under the Taylor Morrison, Darling Homes Collection by Taylor Morrison and Esplanade brand names in Arizona, California, Colorado, Florida, Georgia, Indiana, Nevada, North Carolina, South Carolina, Oregon, Texas and Washington. Taylor Morrison was founded in 1936 and is headquartered in Scottsdale, Arizona.

Taylor Morrison has a Quality Grade of A, with a score of 92, which is very strong. The company ranks strongly in terms of its F-Score and its return on assets. Its F-Score of 8 ranks in the 94th percentile among all U.S.-listed stocks, and its return on assets of 9.7% ranks in the 87th percentile. Taylor Morrison has a return on invested capital of 17.2%, below the sector median of 18.3%, and a buyback yield of 5.7%.

Taylor Morrison has a Value Grade of A, based on a score of 94, which is deep value. The company ranks in the 13th percentile for its shareholder yield and in the 15th percentile for its enterprise-value-to-EBITDA ratio. It has a shareholder yield of 5.7% and an enterprise-value-to-EBITDA ratio of 6.2. A lower price-earnings ratio is considered better value, and Taylor Morrison’s price-earnings ratio of 7.7 ranks in the 9th percentile, below the sector median of 20.9. The price-to-sales ratio is 0.81, which ranks in the 27th percentile.

The company has a Momentum Grade of C, based on its Momentum Score of 54. This means that the stock’s momentum is average in terms of its weighted relative price strength over the last four quarters. The ranks are 71, 37, 30 and 66, sequentially from the most recent quarter. The weighted four-quarter relative price strength is –0.3%.

Taylor Morrison has a Growth Grade of A, which is very strong. The company ranks in the 80th percentile for its five-year annualized sales growth rate of 11.4%.