Gold Soars, but the Reason Isn't Clear

Gold surged past $4,300 per ounce with a 64% gain in 2025, but the reason isn’t clear. Explore possible drivers behind the rally, from momentum and safe-haven demand to global debt worries.

Gold is glittering. Today, the precious metal traded above $4,300 per ounce for the first time. It currently has a 64% year-to-date gain.

What’s driving the rally? That’s a good question. I am admittedly not sure. I do have some thoughts, but before I share them, I want to show you what I’m seeing.

Let’s start with momentum and speculation. Rising prices attract buyers. Exchange-traded funds (ETFs) have made it easy to buy and sell gold with minimal transaction costs. Plus, investing in an ETF allows an investor to avoid the storage issues that come with owning the physical metal.

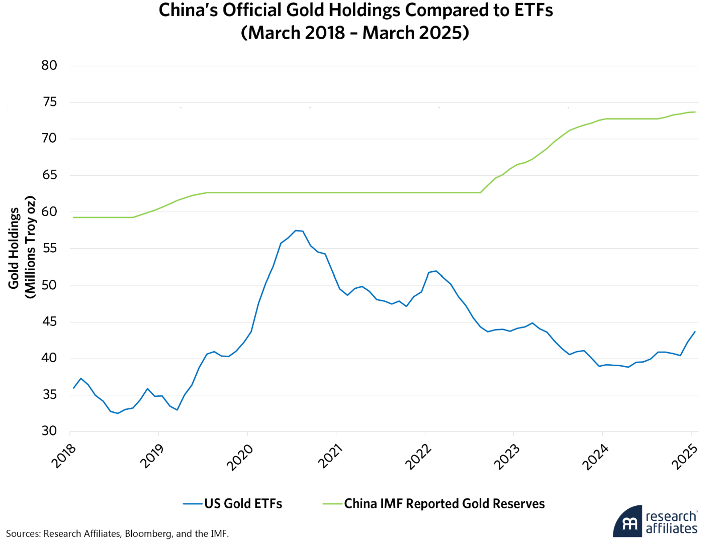

China has been building up its gold reserves, as the chart below from Research Affiliates shows. However, the current big run-up in gold prices started more than one year after the reported figures showed a significant increase in China’s gold holdings.

Worries about sovereign debt are being cited as a reason for gold’s ascent. Such worries are not new. France’s inability to deal with its debt load—or to even keep a prime minister—has been ongoing. Many other countries have large amounts of debt too.

In the U.S., we have our own debt issues, not to mention our ongoing political dysfunction. Yet, worries about a debasement of the U.S. dollar have yet to show signs of coming to fruition. Yes, the U.S. dollar is weaker now than it was at the start of the year, but it is still strong relative to a basket of our trading partners’ currencies, as shown by this chart from the St. Louis Federal Reserve’s FRED database.

What about the threat of hyperinflation, or at least higher inflation? That’s not being priced into the bonds. Rather, the breakeven rate shows traders betting that inflation will average between 2.0% and 2.5% over the next 10 years.

So, why is gold rising? I have a few theories:

Momentum: The rise in gold prices is attracting more investors who want to profit from the rally.

Dissatisfaction With Government: There is a lot of frustration with government leaders across the globe. Here in the U.S., polls show that a growing number of Americans think the U.S. is going in the wrong direction.

Desire for a Safe Haven: Gold has a centuries-old reputation as a safe haven of wealth.

Inflation: Though headline inflation has cooled, investors are very attuned to price changes. Rising grocery prices are particularly noticeable.

Regardless of the reason for this year’s rally, we must understand that gold goes through spurts of big rallies and big bear markets. Just because the precious metal is making portfolios shine now doesn’t mean it will do so in the future. Investors who overpaid for gold have gone on to regret doing so.

Investor Update Archives

October 9, 2025 More Time Spent on Your Portfolio Can Worsen Returns

October 2, 2025 Mutual Funds to Gain ETF Tax Advantages and Intraday Trading

September 25, 2025 Options for Your Cash as More Fed Rate Cuts Are Likely

September 18, 2025 September Charts of Interest: Rate Cuts, Plus a 3,821% Investment Return