Freedom-Focused Emerging Markets Fund Taps Into Local Growth

Freedom weighting results in lower autocracy risk and more sustainable growth in emerging markets.

Perth Tolle founded Life + Liberty Indexes and created the first emerging markets exchange-traded fund (ETF) based on a freedom-weighted strategy, the Freedom 100 Emerging Markets ETF (FRDM). Cynthia McLaughlin and Charles Rotblut, CFA, sat down with Tolle in late February to discuss the ins and outs of investing in emerging markets.

Cynthia McLaughlin (CM): Why should investors invest in emerging markets?

Perth Tolle: Emerging markets provide diversification from the U.S., especially at a time when U.S. valuations are so much higher relative to the rest of the world. Emerging markets rank as the cheapest in the world as far as equity asset classes go—even cheaper than developed international markets, whose valuations are already much lower than U.S. stocks currently.

Demographics are also more attractive in emerging markets relative to developed markets. Many of the emerging market countries we invest in [at Life + Liberty Indexes] have even stronger demographic trends, largely because their citizens enjoy a greater degree of freedom. We think that’s a very important advantage.

Lastly, emerging markets are poised to provide 60% of world gross domestic product (GDP) growth going forward. And these countries are growing from a very low base relative to developed markets.

Diversification, favorable demographics, attractive relative valuations and high expected participation in world economic growth going forward are characteristics that are advantageous for investors to capture in emerging markets.

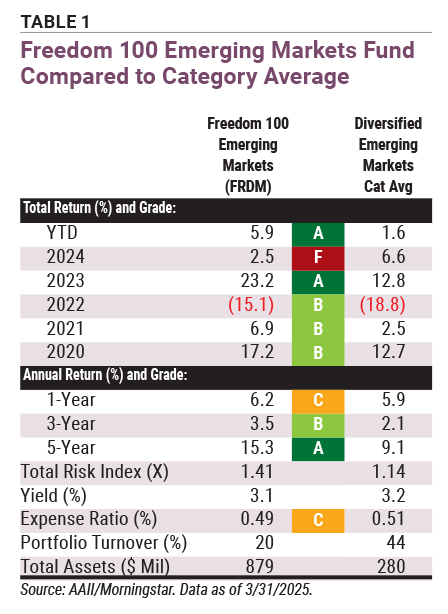

[For complete stats on the Freedom 100 Emerging Markets ETF, see its Fund Evaluator page.]