December Charts of Interest: Changes Among the Interest-Rate Setters

Explore Fed rate-cut expectations, FOMC changes, consumer sentiment, 2026 stock forecasts, ETF selection trends and the rising cost of Christmas.

The future direction of monetary policy headlines this year’s final charts of interest. I look at the latest policy projections as well as the upcoming changes in who gets to vote on Federal Open Market Committee (FOMC) decisions. I then turn to the subjects of how consumers are feeling about holiday shopping, the stocks analysts think will have the biggest price increases and decreases, and the traits investors seek in exchange-traded funds (ETFs). And since it is the holiday season, I end with this year’s cost of Christmas.

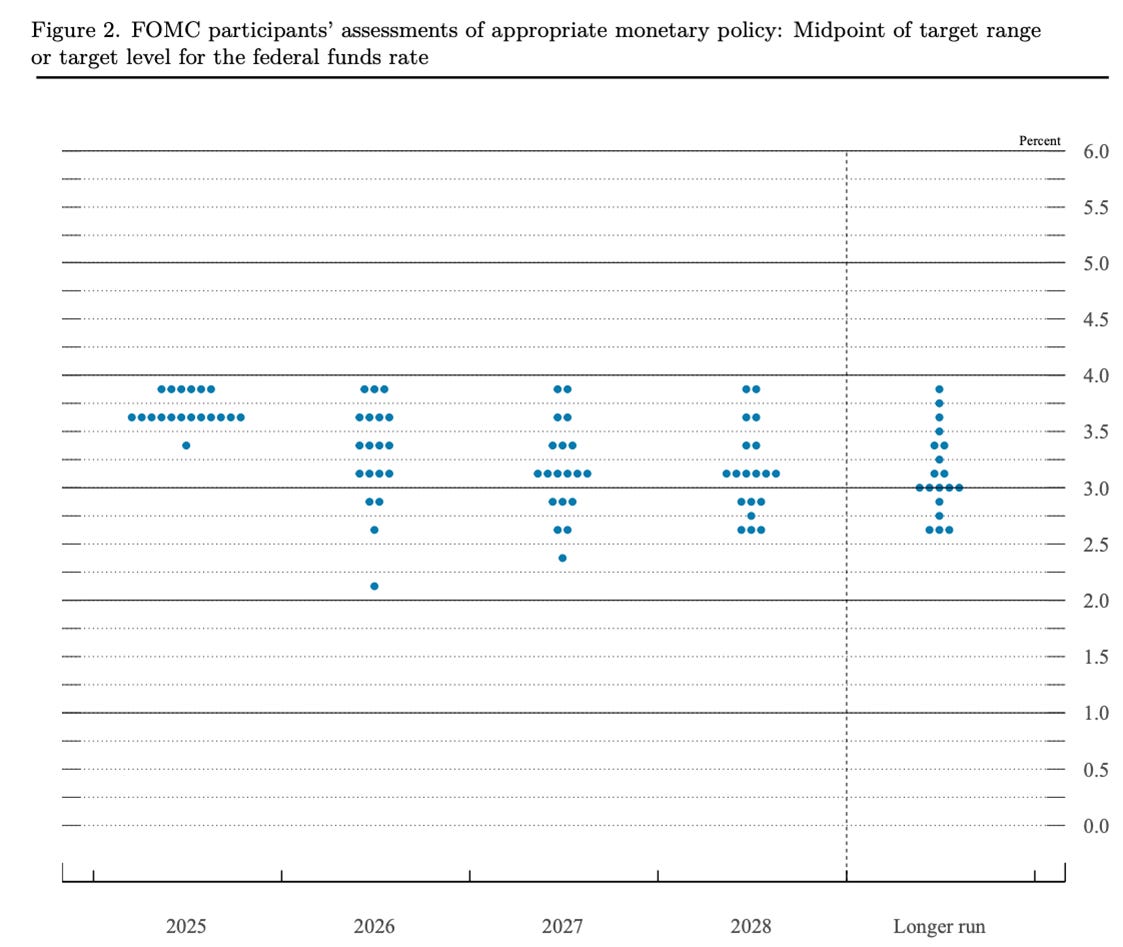

Just One Interest Rate Cut Next Year?

The FOMC’s latest projections call for just one quarter-point (0.25%) interest rate cut next year. There is dispersion among those projections, as the dot plot below shows. The bottom dot is once again attributable to Federal Reserve governor Stephen Miran.

Source: Federal Open Market Committee.

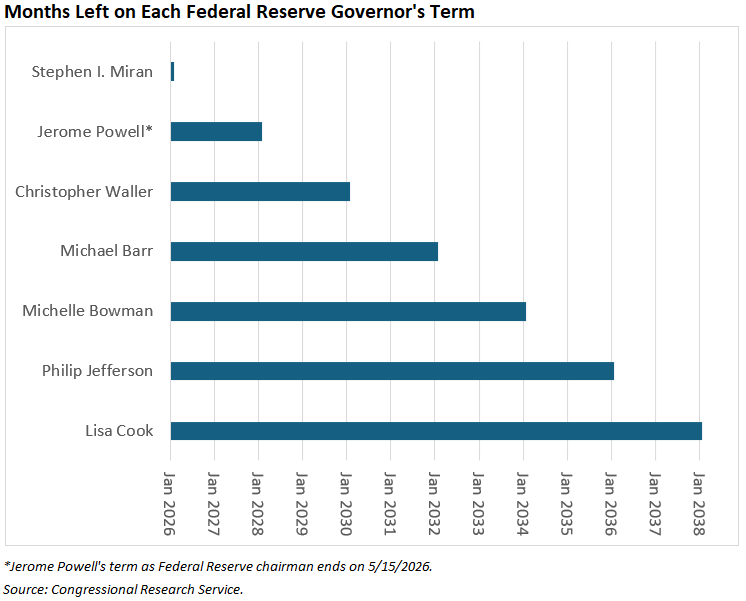

How much the FOMC cuts interest rates next year will depend in part on who President Donald Trump appoints. Miran’s term as a Fed governor will expire at the end of January 2026. Jerome Powell’s term as Fed chairman expires in May 2026, but his term as a Fed governor does not expire until 2028. Powell has not said whether he intends to complete his term as governor.

Atlanta Federal Reserve president Raphael Bostic will retire in February 2026. His replacement, who will be selected by a group of the regional bank’s directors, will not serve as a voting member of the FOMC until 2027. The Cleveland, Philadelphia, Dallas and Minneapolis bank presidents will rotate in as voting members in 2026. The Wall Street Journal describes three of these regional bank presidents as having recently made hawkish comments.

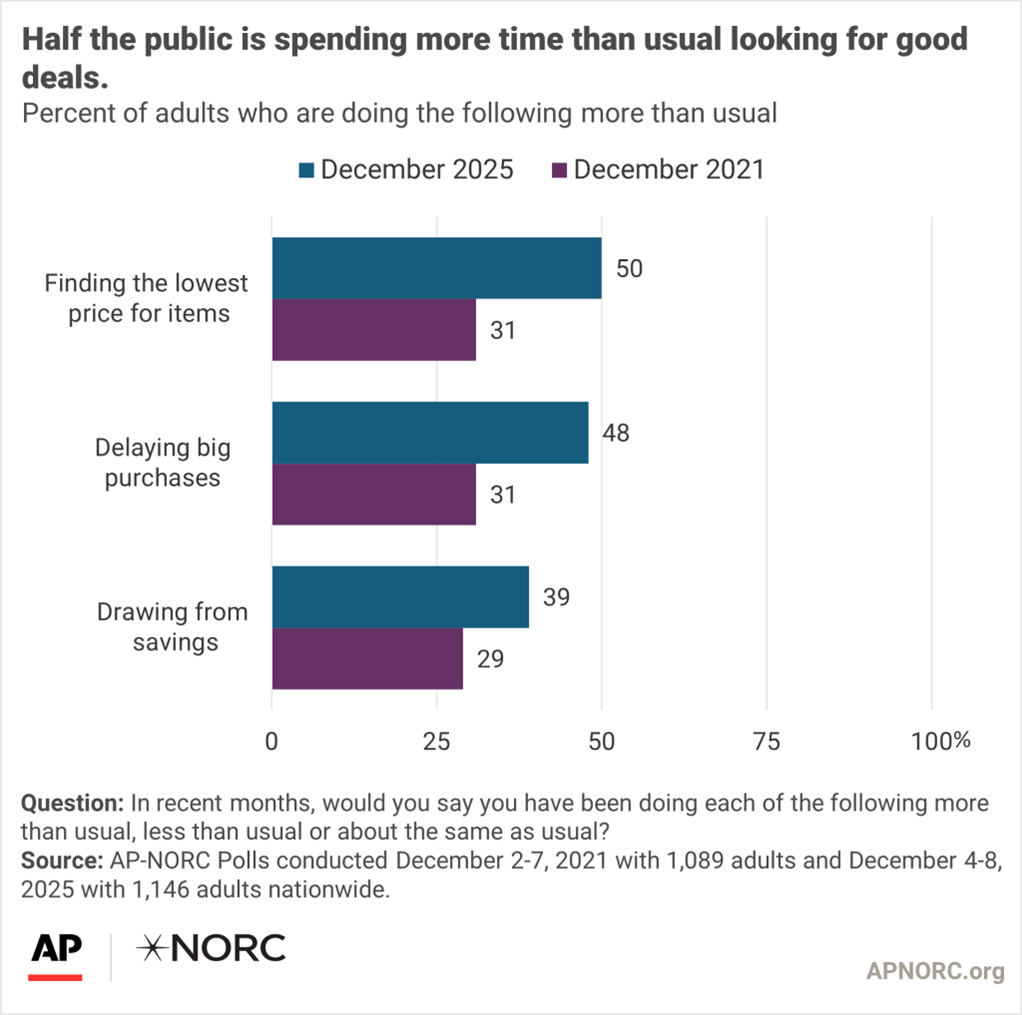

Consumers Are Feeling Bah Humbug

A poll from the Associated Press and NORC found that “More Americans are tightening their belts this holiday season compared with the last time this question was asked in December 2021 as inflation was starting to climb.” Lower- and middle-income adults in particular are finding it harder to afford the gifts they want to give.

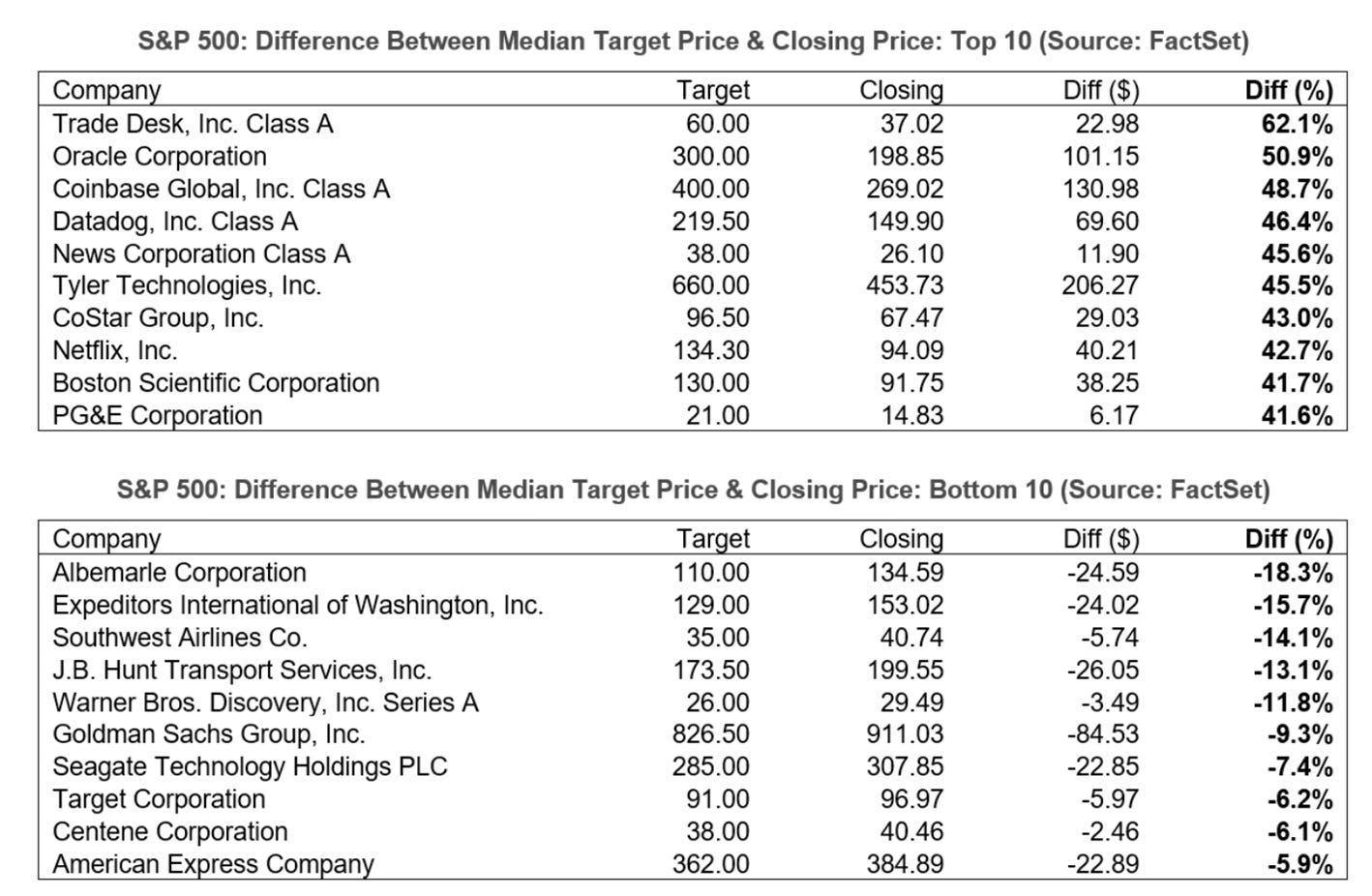

Analysts’ Biggest Winners and Losers for 2026

FactSet listed the S&P 500 index stocks that analysts expect to see the largest share price increases and decreases in 2026. Both the gains and losses were calculated as the difference between the median of analysts’ 2026 price targets and each stock’s closing price as of Thursday, December 11, 2025.

Contrarians may want to note the presence of Albemarle Corp. (ALB), Southwest Airlines Co. (LUV) and J.B. Hunt Transport Services Inc. (JBHT) in the Bottom 10 chart. These three companies were all on the list of stocks with the potential to outperform that I shared in last week’s Investor Update.

The high level of dispersion among analysts’ earnings expectations for these three stocks increases the likelihood of the current price targets being way off. We just don’t know whether the price targets will end up being too pessimistic or too optimistic.

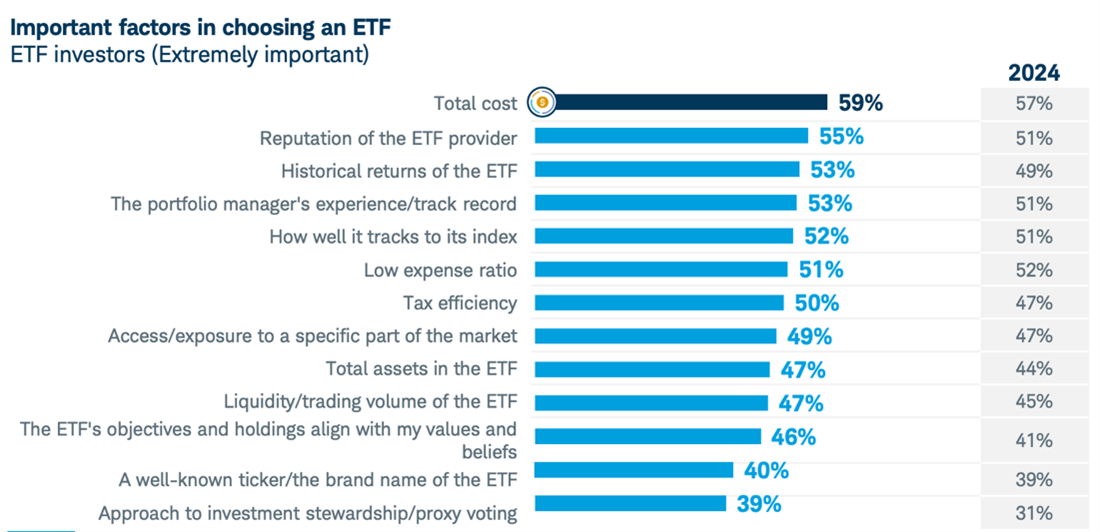

Investors Focus on Cost When Selecting an ETF

Total cost remains the top factor investors consider when selecting an exchange-traded fund (ETF), according to Charles Schwab’s 2025 ETFs and Beyond Study. However, the discount broker did not define total cost. I point this out because low expense ratios ranked sixth in terms of the most important factors picked.

We define the total cost of an ETF as including the expense ratio, tax cost, difference between the bid and ask prices and tracking error—that is, the difference between the ETF’s net asset value (NAV) and its trading price. The expense ratio, tax cost ratio and tracking error can all be found on an ETF’s Evaluator page on AAII.com. Just type the ETF’s name or ticker symbol into the search box located at the top of any page on our website.

Source: Charles Schwab Asset Management.

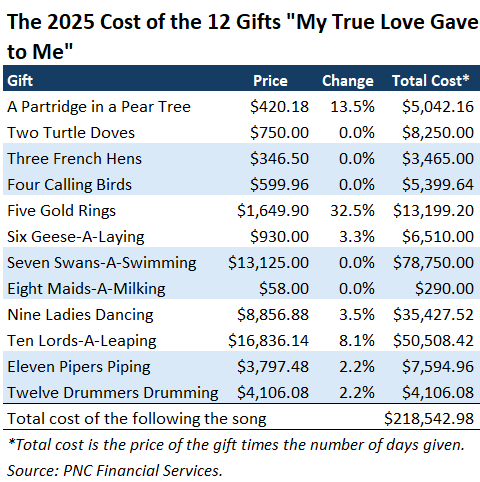

Christmas Will Cost 4.5% More This Year

PNC Financial Services’ latest Christmas Price Index reveals that the cost of buying all 12 gifts from the song “The Twelve Days of Christmas” is 4.5% higher relative to one year ago. Buying all the gifts just once will cost you $51,476.12. If you want to truly treat your true love by following all of the song’s verses, you will need to spend $218,542.98 (and have a pool large enough for all those swans to swim in).

Gold rings were the biggest contributor to the increased cost, jumping 32.5%. Partridges in a pear tree were more expensive because higher lumber costs increased the price of trees. The lords-a-leaping will charge you 8.1% more because of the higher aggregate cost of performers.

PNC Financial Services chief investment officer Amanda Agati said tariffs did not impact the cost of Christmas. Why? “Because True Love’s shopping list only includes domestically produced goods and services.”