Checking the Power of Three Gas Utility Stocks

Analyze Brookfield Infrastructure, National Fuel Gas and Suburban Propane using AAII’s A+ Stock Grades to see how gas utility stocks stack up amid rising power demand.

This week, we use AAII’s A+ Investor Stock Grades to provide insight into three gas utility stocks. As electricity demand continues to rise and grid reliability remains a priority, should you consider the three stocks of Brookfield Infrastructure Corp. (BIPC), National Fuel Gas Co. (NFG) and Suburban Propane Partners L.P. (SPH)?

Gas Utility Stocks Recent News

The U.S. natural gas utilities and infrastructure industry is facing rising long-term demand as electricity consumption increases with the expansion of artificial intelligence (AI) data centers. According to Deloitte’s 2025 AI Infrastructure Survey, power demand from AI data centers in the U.S. could grow more than thirtyfold by 2035, increasing from approximately four gigawatts in 2024 to an estimated 123 gigawatts. AI data centers require significantly more electricity per square foot than traditional data processing facilities and operate on a continuous basis, placing sustained pressure on power generation and fuel supply systems.

The report cites grid capacity constraints and the need for power sources that can be adjusted with demand as key challenges. Deloitte notes that despite rapid growth in renewable capacity, recent power load growth in major data center markets has been met primarily through increased natural gas generation. More than 99 gigawatts of gas-fired power capacity is planned across the U.S., underscoring the importance of reliable gas delivery infrastructure.

As electricity demand rises and grid reliability remains a priority, might Brookfield Infrastructure, National Fuel Gas and Suburban Propane Partners gain from these developing trends?

Grading Gas Utility Stocks With AAII’s A+ Stock Grades

When analyzing a company, it is helpful to have an objective framework that allows you to compare companies in the same way. This is why AAII created the A+ Stock Grades, which evaluate companies across five fundamental factors that research and real-world investment results indicate to identify market-beating stocks in the long run: value, growth, momentum, earnings estimate revisions (and surprises) and quality.

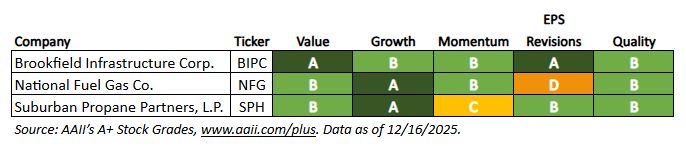

Using AAII’s A+ Stock Grades, the following table summarizes the attractiveness of three gas utility stocks—Brookfield Infrastructure, National Fuel Gas and Suburban Propane Partners—based on their fundamentals.

AAII’s A+ Stock Grade Summary for Three Gas Utility Stocks

What the A+ Stock Grades Reveal

Brookfield Infrastructure Corp. (BIPC), together with its subsidiaries, owns and operates utility investments in Brazil, the U.K. and other countries. It also engages in the regulated gas and electricity business and operates regulated natural gas transmission systems. The company operates approximately 2,000 kilometers of natural gas transportation pipelines in the Brazilian states of Rio de Janeiro, Sao Paulo and Minas Gerais; 4.7 million gas and electricity connections in the U.K.; and a global fleet of approximately seven million 20-foot equivalent units (TEUs) intermodal containers under long-term contracts. The company was incorporated in 2019 and is headquartered in New York City, New York. Brookfield Infrastructure is a subsidiary of Brookfield Infrastructure Partners L.P. (BIP).

Brookfield Infrastructure has a Momentum Grade of B, based on its Momentum Score of 61. This means that the stock’s momentum has been strong in terms of its weighted relative price strength over the last four quarters. The weighted four-quarter relative strength rank is the relative price change for each of the past four quarters, with the most recent quarterly price change given a weight of 40% and each of the three previous quarters given a weight of 20%. The ranks are 72, 38, 76 and 41, sequentially from the most recent quarter. The weighted four-quarter relative price strength is 1.4%.

Higher-quality stocks possess traits associated with upside potential and reduced downside risk. Brookfield Infrastructure has a Quality Grade of B, based on a score of 63, which is strong. The A+ Quality Grade is the percentile rank of the average of the percentile ranks of return on assets (ROA), return on invested capital (ROIC), gross income to assets, buyback yield, change in total liabilities to assets, accruals to assets, Z double prime bankruptcy risk (Z) score and F-Score. The score is variable, meaning it can consider all eight measures or, should any of the eight measures not be valid, the valid remaining measures. To be assigned a Quality Score, though, stocks must have a valid (non-null) measure and corresponding ranking for at least four of the eight quality measures.

The company ranks strongly in terms of its buyback yield and return on invested capital. Its buyback yield of 16.8% ranks in the 98th percentile among all U.S.-listed stocks, and its return on invested capital of 23.9% ranks in the 68th percentile. Brookfield Infrastructure has an F-Score of 5, in line with the sector median. The F-Score is a number between 0 and 9 that assesses the strength of a company’s financial position. It considers the profitability, leverage, liquidity and operating efficiency of a company.

The components of the Growth Composite Score consider a company’s success in growing sales on a year-over-year and long-term annualized basis and its ability to consistently generate positive cash from its core operations. Brookfield Infrastructure’s Growth Grade is B, which is strong. The company has generated positive annual cash from operations in the past five consecutive years and has a five-year annualized sales growth rate of 17.8%.

National Fuel Gas Co. (NFG) operates as a diversified energy company through three segments: integrated upstream and gathering, pipeline and storage, and utility. The integrated upstream and gathering segment explores for, develops and produces natural gas and oil. It also builds, owns and operates gathering facilities in the Appalachian region, as well as provides gathering services to Seneca Resources Co. LLC. The pipeline and storage segment provides interstate natural gas transportation services through an integrated gas pipeline system in Pennsylvania and New York and offers storage services through its underground natural gas storage fields. Additionally, this segment transports and stores natural gas for National Fuel Gas Distribution Corp., as well as for utilities, industrial companies and power producers in New York. The utility segment sells natural gas to retail customers and provides natural gas utility services to customers in Buffalo, Niagara Falls and Jamestown, New York, as well as in Erie and Sharon, Pennsylvania. National Fuel Gas was incorporated in 1902 and is headquartered in Williamsville, New York.

National Fuel Gas has a Value Grade of B, based on a score of 67, which is good value. The Value Grade is the percentile rank of the average of the percentile ranks of the price-to-sales (P/S) ratio, price-earnings (P/E) ratio, price-to-book-value (P/B) ratio, price-to-free-cash-flow (P/FCF) ratio, shareholder yield and the ratio of enterprise value to earnings before interest, taxes, depreciation and amortization (EBITDA).

The company ranks in the 22nd percentile for its shareholder yield and in the 16th percentile for its enterprise-value-to-EBITDA ratio, where a lower rank is more favorable. The company has a shareholder yield of 3.6% and an enterprise-value-to-EBITDA ratio of 6.4. A lower price-earnings ratio is also considered better value, and National Fuel Gas’ price-earnings ratio of 14.3 is below the sector median of 19.3. Its price-to-sales ratio is 3.24, which ranks in the 65th percentile.

Earnings estimate revisions indicate how analysts view a firm’s short-term prospects. National Fuel Gas has an Earnings Estimate Revisions Grade of D, based on a score of 35, which is negative. The grade is based on the statistical significance of its latest two quarterly earnings surprises and the percentage change in its consensus estimate for the current fiscal year over the past month and past three months. National Fuel Gas reported a positive earnings surprise of 9.7% for its fiscal fourth quarter of 2025 ended September 30. In the prior quarter, it reported a positive earnings surprise of 6.2%. Over the last month, the consensus earnings estimate for fiscal first-quarter 2026 has increased from $1.912 to $1.982 per share. The estimate for fiscal-year 2026 ending September 2026 has decreased from $8.019 to $8.008 per share over the last month.

The company has a Momentum Grade of B, based on its Momentum Score of 65. This means that the stock’s momentum is strong in terms of its weighted relative price strength over the last four quarters. The ranks are 40, 39, 70 and 93, sequentially from the most recent quarter. The weighted four-quarter relative price strength is 2.8%, compared to the sector median of 1.8%.

National Fuel Gas has a Growth Grade of A, which is very strong. Its five-year annualized sales growth rate is 8.1%, compared to the sector median of 4.5%. The company has generated positive annual cash from operations in the past five consecutive years.

Suburban Propane Partners L.P. (SPH), through its subsidiaries, engages in the retail marketing and distribution of propane, renewable propane, renewable natural gas, fuel oil and refined fuels in the U.S. It operates through four segments: propane, fuel oil and refined fuels, natural gas and electricity, and other. The propane segment is involved in the retail distribution of propane for space heating, water heating, cooking and clothes drying, as well as for use as a motor fuel in internal combustion engines to power over-the-road vehicles, forklifts and stationary engines. This segment also supplies propane to industrial customers and agricultural markets. Its fuel oil and refined fuels segment engages in the retail distribution of fuel oil, diesel, kerosene and gasoline to residential and commercial customers for use primarily as a source of heat in homes and buildings. The natural gas and electricity segment markets natural gas and electricity to residential and commercial customers in the deregulated energy markets. The other segment sells, installs and services a range of home comfort equipment, including whole-house heating products, air cleaners, humidifiers and space heaters. Suburban Propane Partners was founded in 1945 and is headquartered in Whippany, New Jersey.

Suburban Propane Partners has a Value Grade of B, based on its Value Score of 67, which is good value. The company ranks in the 16th percentile for its shareholder yield and in the 29th percentile for its price-to-sales ratio. The company has a shareholder yield of 5.0% and price-to-sales ratio of 0.85. Suburban Propane Partners’ price-earnings ratio of 11.6 is below the sector median of 19.3.

Suburban Propane Partners has a Quality Grade of B, based on its score of 75, which is strong. The company ranks highly in terms of its return on assets and return on invested capital. Its return on assets of 4.7% ranks in the 71st percentile among all U.S.-listed stocks, and its return on invested capital of 27.3% ranks in the 72nd percentile. National Fuel Gas has an F-Score of 7, compared to the sector median of 5.

Suburban Propane Partners has a Growth Grade of A, which is very strong. The company has a five-year annualized sales growth rate of 5.3%. It has also generated positive annual cash from operations in the past five consecutive years.

This article comes at the perfect time as I was just thinking about AI's power draw during my Pilates practice, truly insightful and smart!