Checking the Health of Three Pharmaceutical Stocks

Explore whether Collegium (COLL), Jazz Pharmaceuticals (JAZZ) and Pacira BioSciences (PCRX) stand out using AAII’s A+ Stock Grades amid strong industry growth trends.

This week, we use AAII’s A+ Investor Stock Grades to provide insight into three pharmaceutical stocks. With demographic shifts, rising health care expenditures and continued advancements in drug development and medical technology, should you consider the three stocks of Collegium Pharmaceutical Inc. (COLL), Jazz Pharmaceuticals PLC (JAZZ) and Pacira BioSciences Inc. (PCRX)?

Pharmaceutical Stocks Recent News

The pharmaceutical industry is forecast to experience steady and sustained growth over the next decade. According to Vision Research Reports, the global market is projected to expand at a compound annual growth rate (CAGR) of 6.2% from 2025 to 2034, increasing from $1.68 trillion in 2024 to over $3.07 trillion by 2034.

The report cites sustained demand for pharmaceutical products, treatments and therapies as contributing to the industry’s expansion. According to the World Health Organization, noncommunicable diseases account for 74% of all deaths worldwide. Health care spending is also accelerating in emerging markets such as India and China, where infrastructure investment and access to care are expanding rapidly. Meanwhile, advances in artificial intelligence (AI) and precision medicine are reshaping how drugs are developed, resulting in faster, more targeted treatments with better patient outcomes.

As global health care needs grow and innovation accelerates, might Collegium Pharmaceutical, Jazz Pharmaceuticals and Pacira BioSciences gain from the developing trends?

Grading Pharmaceutical Stocks With AAII’s A+ Stock Grades

When analyzing a company, it is helpful to have an objective framework that allows you to compare companies in the same way. This is why AAII created the A+ Stock Grades, which evaluate companies across five fundamental factors that research and real-world investment results indicate to identify market-beating stocks in the long run: value, growth, momentum, earnings estimate revisions (and surprises) and quality.

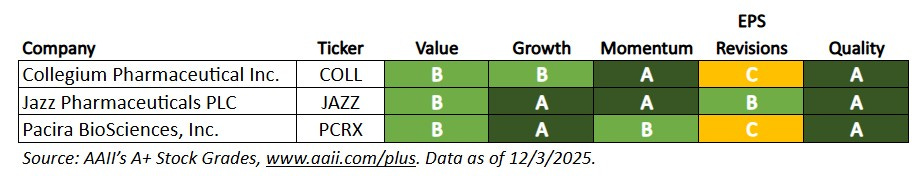

Using AAII’s A+ Stock Grades, the following table summarizes the attractiveness of three pharmaceutical stocks—Collegium Pharmaceutical, Jazz Pharmaceuticals and Pacira BioSciences—based on their fundamentals.

AAII’s A+ Stock Grade Summary for Three Pharmaceutical Stocks

What the A+ Stock Grades Reveal

Collegium Pharmaceutical Inc. (COLL), a specialty pharmaceutical company, engages in the development and commercialization of medicines for pain management. The company’s portfolio includes Jornay PM, a central nervous system medicine for the treatment of attention-deficit/hyperactivity disorder (ADHD); Belbuca for severe and persistent pain; Xtampza ER, an abuse-deterrent, extended-release, oral formulation of oxycodone; Nucynta ER and Nucynta IR, indicated for pain management; and Symproic for the treatment of opioid-induced constipation. The company was formerly known as Collegium Pharmaceuticals Inc. and changed its name to Collegium Pharmaceutical Inc. in October 2003. Collegium Pharmaceutical was incorporated in 2002 and is headquartered in Stoughton, Massachusetts.

Collegium Pharmaceutical has a Momentum Grade of A, based on its Momentum Score of 82. This means that the stock’s momentum has been strong in terms of its weighted relative price strength over the last four quarters. The weighted four-quarter relative strength rank is the relative price change for each of the past four quarters, with the most recent quarterly price change given a weight of 40% and each of the three previous quarters given a weight of 20%. The ranks are 80, 87, 62 and 50, sequentially from the most recent quarter. The weighted four-quarter relative price strength is 9.0%.

Higher-quality stocks possess traits associated with upside potential and reduced downside risk. Collegium Pharmaceutical has a Quality Grade of A, based on a score of 98, which is very strong. The A+ Quality Grade is the percentile rank of the average of the percentile ranks of return on assets (ROA), return on invested capital (ROIC), gross income to assets, buyback yield, change in total liabilities to assets, accruals to assets, Z double prime bankruptcy risk (Z) score and F-Score. The score is variable, meaning it can consider all eight measures or, should any of the eight measures not be valid, the valid remaining measures. To be assigned a Quality Score, though, stocks must have a valid (non-null) measure and corresponding ranking for at least four of the eight quality measures.

The company ranks strongly in terms of its gross income to assets and return on invested capital. Its gross income to assets of 41.5% ranks in the 83rd percentile among all U.S.-listed stocks, and its return on invested capital of 98.5% ranks in the 94th percentile. Collegium Pharmaceutical has an F-Score of 8, compared to the sector median of 3. The F-Score is a number between 0 and 9 that assesses the strength of a company’s financial position. It considers the profitability, leverage, liquidity and operating efficiency of a company. The company also has a buyback yield of 2.1%, which ranks in the 81st percentile and is above the sector median of –8.1%.

The components of the Growth Composite Score consider a company’s success in growing sales on a year-over-year and long-term annualized basis and its ability to consistently generate positive cash from its core operations. Collegium Pharmaceutical’s Growth Grade is B, which is strong. The company has generated positive annual cash from operations in the past five consecutive years and has a five-year annualized sales growth rate of 16.3%.

Jazz Pharmaceuticals PLC (JAZZ) identifies, develops and commercializes pharmaceutical products for unmet medical needs in the U.S. and internationally. Some of its treatments include Zanidatamab for gastroesophageal adenocarcinoma, Suvecaltamide for Parkinson’s disease tremor, JZP150 for post-traumatic stress disorder (PTSD), and JZP441 for narcolepsy and other sleep disorders. The company also has licensing and collaboration agreements with other drug development programs. The company was incorporated in 2003 and is headquartered in Dublin, Ireland.

Jazz Pharmaceuticals has a Quality Grade of A, with a score of 92, which is very strong. The company ranks highly in terms of its gross income to assets and return on invested capital. Its gross income to assets of 33.7% ranks in the 76th percentile among all U.S.-listed stocks, and its return on invested capital of 52.8% ranks in the 88th percentile. Jazz Pharmaceuticals has an F-Score of 6, compared to the sector median of 3. The company also has a ratio of accruals to assets of–15.5%, which ranks in the 84th percentile.

Jazz Pharmaceuticals has a Value Grade of B, based on a score of 69, which is good value. The Value Grade is the percentile rank of the average of the percentile ranks of the price-to-sales (P/S) ratio, price-earnings (P/E) ratio, price-to-book-value (P/B) ratio, price-to-free-cash-flow (P/FCF) ratio, shareholder yield and the ratio of enterprise value to earnings before interest, taxes, depreciation and amortization (EBITDA).

The company ranks in the 36th percentile for its shareholder yield and in the 19th percentile for its enterprise-value-to-EBITDA ratio. The company has a shareholder yield of 1.2% and an enterprise-value-to-EBITDA ratio of 7.1. A lower price-to-free-cash-flow ratio is considered better value, and Jazz Pharmaceuticals’ price-to-free-cash-flow ratio of 7.8 is below the sector median of 22.4. Its price-to-sales ratio is 2.53, which ranks in the 57th percentile.

The company has a Momentum Grade of A, based on its Momentum Score of 84. This means that the stock’s momentum is very strong in terms of its weighted relative price strength over the last four quarters. The ranks are 88, 74, 16 and 86, sequentially from the most recent quarter. The weighted four-quarter relative price strength is 10.5%, compared to the sector median of –2.3%.

Jazz Pharmaceuticals has a Growth Grade of A, which is very strong. Its five-year annualized sales growth rate is 13.5%, compared to the sector median of 10.9%. The company has generated positive annual cash from operations in the past five consecutive years.

Pacira BioSciences Inc. (PCRX) engages in the development, manufacture, marketing, distribution and sale of non-opioid pain management and regenerative health solutions to health care practitioners in the U.S. The company offers Exparel, an injectable suspension for postsurgical pain management; Zilretta, an extended-release injectable suspension for the management of osteoarthritis and knee pain; and the iovera system, a non-opioid handheld device used to deliver controlled doses of cold temperature to targeted nerves to interrupt the pain-transmitting signals of a peripheral nerve. Pacira BioSciences also is developing PCRX-201, a novel gene therapy vector platform enabling local administration of genetic medicines with the potential to treat large prevalent diseases like osteoarthritis. The company was formerly known as Pacira Pharmaceuticals Inc. and changed its name to Pacira BioSciences Inc. in April 2019. Pacira BioSciences was incorporated in 2006 and is headquartered in Tampa, Florida.

Pacira BioSciences has a Value Grade of B, based on its Value Score of 66, which is good value. The company ranks in the 18th percentile for its shareholder yield and in the 32nd percentile for its enterprise-value-to-EBITDA ratio. The company has a shareholder yield of 4.5% and an enterprise-value-to-EBITDA ratio of 9.3. Pacira BioSciences’ price-to-free-cash-flow ratio of 8.7 is below the sector median of 22.4. Its price-to-sales ratio is 1.49, which ranks in the 42nd percentile.

Earnings estimate revisions indicate how analysts view a firm’s short-term prospects. Pacira BioSciences has an Earnings Estimate Revisions Grade of C, based on a score of 58, which is neutral. The grade is based on the statistical significance of its latest two quarterly earnings surprises and the percentage change in its consensus estimate for the current fiscal year over the past month and past three months. Pacira BioSciences reported a positive earnings surprise of 7.4% for the third quarter of 2025. In the prior quarter, it reported a positive earnings surprise of 4.2%. Over the last month, the consensus earnings estimate for fourth-quarter 2025 has increased from $0.861 to $0.902 per share and the estimate for full-year 2025 has increased from $2.872 to $2.959 per share.

Pacira BioSciences has a Growth Grade of A, which is very strong. The company has a five-year annualized sales growth rate of 10.7%. It has also generated positive annual cash from operations in each of the past five consecutive years.