Checking the Altitude of Three Airline Stocks

Airline revenues may reach $979B in 2025. See how Allegiant (ALGT), Delta (DAL) and United (UAL) rank using AAII’s A+ Stock Grades.

This week, we use AAII’s A+ Investor Stock Grades to provide insight into three airline stocks. With airline industry revenues projected to reach $979 billion in 2025, should you consider the three stocks of Allegiant Travel Co. (ALGT), Delta Air Lines Inc. (DAL) and United Airlines Holdings Inc. (UAL)?

Airline Stocks Recent News

Airline profitability is expected to strengthen in 2025, supported by record travel demand and falling fuel costs. The industry continues to recover as airlines operate at higher capacity levels and benefit from lower operating expenses.

According to the International Air Transport Association (IATA), the number of air travelers is projected to reach a record 4.99 billion globally in 2025, reflecting a 4% year-over-year increase as international routes fully reopen and business travel rebounds. Air passenger revenue is expected to reach $693 billion in 2025, an all-time high driven by steady leisure demand and $144 billion in ancillary income from baggage fees, seat upgrades and other services. Total industry revenue is forecast to rise to $979 billion for 2025, up 1.3% year over year, as air travel continues to expand across major regions such as Asia-Pacific and Europe.

As air travel demand continues to rise, Allegiant Travel, Delta Air Lines and United Airlines may be positioned to benefit from the airline industry’s continued growth in 2025.

Sign Up to Receive a Free Special Report That Shows How A+ Investor Grades Can Help You Make Investment Decisions

Grading Airline Stocks With AAII’s A+ Stock Grades

When analyzing a company, it is helpful to have an objective framework that allows you to compare companies in the same way. This is why AAII created the A+ Stock Grades. They evaluate companies across five factors that research and real-world investment results indicate to identify market-beating stocks in the long run: value, growth, momentum, earnings estimate revisions (and surprises) and quality.

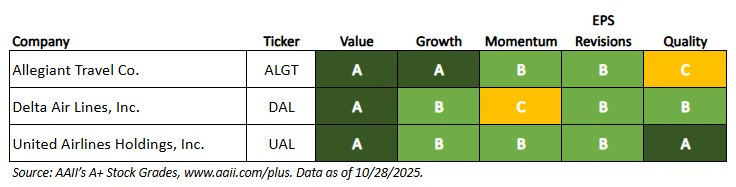

Using AAII’s A+ Stock Grades, the following table summarizes the attractiveness of three airline stocks—Allegiant Travel, Delta Air Lines and United Airlines—based on their fundamentals.

AAII’s A+ Stock Grade Summary for Three Airline Stocks

What the A+ Stock Grades Reveal

Allegiant Travel Co. (ALGT) provides travel and leisure services and products to residents of underserved cities in the U.S. It operates through two segments: airline and Sunseeker Resort. The company offers scheduled air transportation on limited-frequency, nonstop flights between underserved cities and leisure destinations. As of February 1, 2025, it operated a fleet of 119 Airbus A320 series aircraft and four Boeing 737 series aircraft. In addition, it offers third-party travel products, such as hotel rooms and ground transportation; travel insurance from a third-party insurer; and air transportation services through fixed-fee agreements and charter service on a year-round and ad-hoc basis. Further, the company owns and operates a golf course. Allegiant Travel was founded in 1997 and is based in Las Vegas, Nevada.

Allegiant Travel has a Value Grade of A, based on its Value Score of 82, which is deep value. Higher scores indicate a more attractive stock for value investors and, thus, a better grade. The Value Grade is the percentile rank of the average of the percentile ranks of the price-to-sales (P/S) ratio, price-earnings (P/E) ratio, price-to-book-value (P/B) ratio, price-to-free-cash-flow (P/FCF) ratio, shareholder yield and the ratio of enterprise value to earnings before interest, taxes, depreciation and amortization (EBITDA).

Allegiant Travel has an enterprise-value-to-EBITDA ratio of 7.5, which ranks in the 21st percentile among all U.S.-listed stocks. Its price-to-sales ratio is 0.44, which ranks in the 16th percentile and is below the sector median of 1.49. This favorable ratio suggests that Allegiant Travel’s stock may be relatively cheap compared to similar companies in its sector.

Allegiant Travel has a Momentum Grade of B, based on its Momentum Score of 75. This means that the stock’s momentum is strong in terms of its weighted relative price strength over the last four quarters. The weighted four-quarter relative strength rank is the relative price change for each of the past four quarters, with the most recent quarterly price change given a weight of 40% and each of the three previous quarters given a weight of 20%. The quarterly ranks are 76, 58, 5 and 96, sequentially from the most recent quarter, with higher ranks signaling stronger price momentum. The weighted four-quarter relative price strength is 6.2%.

Allegiant Travel has a Growth Grade of A, which is very strong. The components of the Growth Composite Score consider a company’s success in growing sales on a year-over-year and long-term annualized basis and its ability to consistently generate positive cash from its core operations. The company has a five-year annualized sales growth rate of 6.4% and has generated positive annual cash from operations in the past five fiscal years.

Delta Air Lines Inc. (DAL) provides scheduled air transportation for passengers and cargo in the U.S. and internationally. The company operates through two segments: airline and refinery. Its domestic network is centered on core hubs in Atlanta, Detroit, Minneapolis–Saint Paul and Salt Lake City, with coastal hub positions in Boston, Los Angeles, New York–LaGuardia Airport, New York–John F. Kennedy International Airport and Seattle. Its international network is centered on hubs and market presence in Amsterdam, Bogota, Lima, Mexico City, London–Heathrow Airport, Paris–Charles de Gaulle Airport, Santiago, Sao Paulo, Incheon and Tokyo. The company provides aircraft maintenance and engineering support, repair and overhaul services, as well as vacation packages to third-party consumers. The company operates through a fleet of approximately 1,292 aircraft. Delta Air Lines was founded in 1924 and is headquartered in Atlanta, Georgia.

Delta Air Lines has a Quality Grade of B, based on a score of 68, which is strong. Higher-quality stocks possess traits associated with upside potential and reduced downside risk. The Quality Grade is the percentile rank of the average of the percentile ranks of return on assets (ROA), return on invested capital (ROIC), gross profit to assets, buyback yield, change in total liabilities to assets, accruals to assets, Z double prime bankruptcy risk (Z) score and F-Score. To be assigned a Quality Score stocks must have a valid (non-null) measure and corresponding ranking for at least four of the eight quality measures.

Delta Air Lines ranks strongly in terms of its return on assets and F-Score. It has a return on assets of 6.0% and an F-Score of 6. The F-Score is a number between 0 and 9 that assesses the strength of a company’s financial position. It considers the profitability, leverage, liquidity and operating efficiency of a company.

Delta Air Lines has a Value Grade of A, based on a score of 84, which is deep value. The company ranks in the cheapest 18th percentile for its enterprise-value-to-EBITDA ratio and in the cheapest 21st percentile for its price-to-sales ratio. The company has an enterprise-value-to-EBITDA ratio of 6.8 and a price-to-sales ratio of 0.59. A lower price-earnings ratio is also considered better value, and Delta Air Lines has a price-earnings ratio of 8.2, compared to the sector median of 26.9. The company has a price-to-free-cash-flow ratio of 14.1, which ranks in the 35th percentile.

The company has a Momentum Grade of C, based on its Momentum Score of 58. This means that the stock’s momentum is very strong in terms of its weighted relative price strength over the last four quarters. The quarterly ranks are 58, 79, 12 and 86, sequentially from the most recent quarter. The weighted four-quarter relative price strength is 0.0%.

United Airlines Holdings Inc. (UAL) provides air transportation services through its subsidiaries across North America, Asia, Europe, Africa, the Pacific, the Middle East and Latin America. The company transports passengers and cargo using its mainline and regional fleets and offers various ancillary services, including catering, ground handling, flight training through its flight academy and maintenance services for third parties. Formerly known as United Continental Holdings Inc., the company adopted its current name in June 2019. United Airlines was incorporated in 1968 and is headquartered in Chicago, Illinois.

United Airlines has a Quality Grade of A, based on a score of 83, which is very strong. The company ranks strongly in terms of its buyback yield, gross income to assets and return on assets. Its buyback yield of 1.6% ranks in the 79th percentile among all U.S.-listed stocks. Its gross income to assets of 26.3% ranks in the 66th percentile, and its return on assets of 4.4% ranks in the 70th percentile.

The company’s Growth Grade is B, which is strong. United Airlines has realized positive annual cash from operations in four out of the past five fiscal years. It also has a five-year annualized sales growth rate of 5.7%.

Earnings estimate revisions indicate whether analysts’ expectations for the firm’s profits have improved or worsened. United Airlines has an Earnings Estimate Revisions Grade of B, based on a score of 61, which is positive. The grade is based on the statistical significance of its latest two quarterly earnings surprises and the increases in consensus earnings estimate for the current fiscal year over the past month and past three months.

United Airlines reported a positive earnings surprise of 3.8% for the third quarter of 2025. In the prior quarter, it reported a positive earnings surprise of 1.5%. Over the last month, the consensus earnings estimate for fourth-quarter 2025 has been revised upward from $2.932 to $3.280 per share based on four upward and eight downward revisions. Over the last month, the consensus earnings estimate for full-year 2025 has been revised upward from $10.323 to $10.791 per share based on 11 upward and two downward revisions.