Breaking Down Three Chemical Stocks

Analyze Corteva, Mativ Holdings and Nutrien using AAII’s A+ Stock Grades to see how chemical stocks stack up amid cost pressures and shifting demand.

This week, we use AAII’s A+ Investor Stock Grades to provide insight into three stocks in the chemical industry. With chemical companies facing significant headwinds in their supply chain and increased costs since 2021, should you consider the stocks of Corteva Inc. (CTVA), Mativ Holdings Inc. (MATV) and Nutrien Ltd. (NTR)?

Chemical Stocks Recent News

Although chemical producers experienced soft global demand for industrial chemicals in 2025, occasional growth was seen in specialty segments such as agricultural and electronic chemicals. Industry output data shows only modest growth forecasts for 2025–2026, with some regions barely expanding amid tariff pressures and slowing end-market demand. Capital spending across the chemical industry has slowed as companies balance the need for modernization with tight economic conditions and rising financing costs.

The energy transition continues to present both opportunity and competition for the chemical industry. Sustainable and green chemical markets are expanding rapidly, driven by demand for bio-based intermediates and low-emission solutions. On the regulatory front, U.S. chemical oversight continues to evolve under the Toxic Substances Control Act (TSCA). The U.S. Environmental Protection Agency (EPA) has updated new chemical review rules to require stricter evaluation of persistent, bioaccumulative and toxic substances before manufacture. It has also issued risk-management extensions and compliance adjustments for key industrial chemicals.

Collectively, these economic and regulatory forces are shaping the chemical industry’s near-term trajectory, underscoring the importance of agile strategies that emphasize sustainability, cost management and compliance readiness. With both markets expanding and regulations evolving, might companies such as Corteva, Mativ Holdings and Nutrien successfully position themselves for stabilizing demand ahead?

Grading Chemical Stocks With AAII’s A+ Stock Grades

When analyzing a company, it is helpful to have an objective framework that allows you to compare companies in the same way. This is why AAII created the A+ Stock Grades. They evaluate companies across five factors that have been shown to produce market-beating stocks in the long run: value, growth, momentum, earnings estimate revisions (and surprises) and quality.

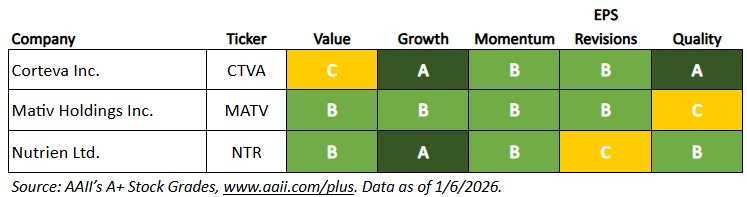

Using AAII’s A+ Stock Grades, the following table summarizes the attractiveness of three chemical stocks—Corteva, Mativ Holdings and Nutrien—based on their fundamentals.

AAII’s A+ Stock Grade Summary for Three Chemical Stocks

What the A+ Stock Grades Reveal

Corteva Inc. (CTVA) is a global agricultural sciences company that specializes in providing high-quality products and solutions for the agriculture industry. The company’s business segments include seed, crop protection and digital agriculture. The seed segment develops and produces a wide variety of genetically enhanced seeds for crops like corn, soybeans and sunflowers, aiming to improve yield and performance. The crop protection segment offers a broad portfolio of herbicides, insecticides and fungicides to protect crops from pests and diseases. In the digital agriculture segment, the company leverages technology to provide data-driven solutions for farmers, helping them optimize crop management. Corteva’s products include seed treatments, herbicides like Enlist and innovative solutions to address global agricultural challenges. The company was incorporated in 2018 and is headquartered in Indianapolis, Indiana.

The company has a Value Grade of C, based on its Value Score of 43, which is average. The Value Grade is the percentile rank of the average of the percentile ranks of the price-to-sales (P/S) ratio, price-earnings (P/E) ratio, price-to-book-value (P/B) ratio, price-to-free-cash-flow (P/FCF) ratio, shareholder yield and the ratio of enterprise value to earnings before interest, taxes, depreciation and amortization (EBITDA).

A lower rank on valuation metrics is more attractive. Among all U.S.-listed stocks, Corteva ranks in the 27th percentile for shareholder yield, 67th percentile for the price-earnings ratio and 58th percentile for the price-to-sales ratio. The company has a shareholder yield of 2.8%, a price-earnings ratio of 28.2 and a price-to-sales ratio of 2.72. It also has a price-to-free-cash-flow ratio of 21.7, which translates to a rank of 52.

Earnings estimate revisions indicate how analysts view a firm’s short-term prospects. Corteva has an Earnings Estimate Revisions Grade of B, based on a score of 67, which is positive. The grade is based on the statistical significance of its latest two quarterly earnings surprises and the percentage change in its consensus estimate for the current fiscal year over the past month and past three months. Corteva reported a positive earnings surprise for third-quarter 2025 of 50.6%, and in the prior quarter reported a positive earnings surprise of 17.1%. Over the last month, the consensus earnings estimate for the fourth quarter of 2025 has decreased slightly from $0.213 to $0.212 per share based on 11 downward and two upward revisions. Over the last three months, the consensus earnings estimate for full-year 2025 has increased from $3.129 to $3.331 per share.

A higher-quality stock possesses traits associated with upside potential and reduced downside risk. Corteva has a Quality Grade of A, with a score of 87, which is very strong. The A+ Quality Grade is the percentile rank of the average of the percentile ranks of return on assets (ROA), return on invested capital (ROIC), gross profit to assets, buyback yield, change in total liabilities to assets, accruals to assets, Z double prime bankruptcy risk (Z) score and F-Score. To be assigned a Quality Score, stocks must have a valid (non-null) measure and corresponding ranking for at least four of the eight quality measures.

Corteva ranks strongly in terms of its buyback yield and F-Score. The company has a buyback yield of 1.8% and an F-Score of 9. The F-Score is a number between 0 and 9 that assesses the strength of a company’s financial position based on its profitability, leverage, liquidity and operating efficiency. The company’s gross income to assets and return on invested capital are above the respective sector medians.

Mativ Holdings Inc. (MATV) is a global leader in advanced materials, specializing in the production of innovative engineered products across various industries. The company operates through multiple segments, including filtration, medical, industrial and consumer products. The filtration segment focuses on the development and supply of high-performance filtration materials used in air, liquid and gas filtration applications. The medical segment provides critical solutions for health care, offering materials used in medical devices and surgical applications. The industrial segment produces engineered materials used in applications like automotive, construction and packaging. The consumer products segment focuses on creating materials used in personal care and household products. Mativ Holdings’ products include nonwoven fabrics, films and specialty materials designed to enhance performance and efficiency across a range of industries. The company was incorporated in 1995 and is headquartered in Alpharetta, Georgia.

Mativ Holdings has a Quality Grade of C, with a score of 49, which is average. The company ranks strongly in terms of its gross income to assets of 17.7%, which is above the sector median of 15.2%. However, the company ranks poorly in terms of its return on assets (19th percentile) and return on invested capital (26th percentile).

Mativ Holdings has a Momentum Grade of B, based on its Momentum Score of 74. This means that the stock’s momentum is strong in terms of its weighted relative strength over the last four quarters. The weighted four-quarter relative strength rank is the relative price change for each of the past four quarters, with the most recent quarterly price change given a weight of 40% and each of the three previous quarters given a weight of 20%. The ranks are 75, 88, 88 and 8, sequentially from the most recent quarter. The weighted four-quarter relative price strength is 6.5%.

The company has a Value Grade of B, based on its Value Score of 74, which is good value. Its price-to-sales ratio is 0.34 and its shareholder yield is 2.7%, ranking in the 13th and 27th percentiles, respectively. Its price-to-free-cash-flow ratio is also attractive at 10.2.

Mativ Holdings has a Growth Grade of B, which is strong. The company has generated positive annual cash from operations in the past five consecutive years and has a strong five-year annual sales growth rate of 14.1%.

Nutrien Ltd. (NTR) is a global leader in the production and distribution of essential agricultural products, specializing in crop nutrients, crop protection and digital agriculture solutions. The company operates through three primary segments: retail, potash and nitrogen. The retail segment provides agricultural products and services, including crop inputs, seed, crop protection chemicals and precision agriculture solutions to farmers. The potash segment focuses on the production and distribution of potash, a key ingredient in fertilizer used to enhance crop growth and yield. The nitrogen segment manufactures nitrogen-based fertilizers essential for growing a variety of crops. The company also offers a range of digital tools designed to help farmers increase productivity and optimize resource use. Nutrien was incorporated in 2017 and is headquartered in Saskatoon, Canada.

Nutrien has a Quality Grade of B, with a score of 79, which is strong. The company ranks strongly in terms of its buyback yield and F-Score. It has a buyback yield of 1.9% and an F-Score of 8.

The company has a Momentum Grade of B, based on its Momentum Score of 61. This means that the stock’s momentum is strong in terms of its weighted relative price strength over the last four quarters. The ranks are 49, 41, 69 and 81, sequentially from the most recent quarter. The weighted four-quarter relative price strength is 1.8%.

The company has a Value Grade of B, based on its Value Score of 78, which is good value. It has an enterprise-value-to-EBITDA ratio of 7.6 and a price-to-book ratio of 1.17, ranking in the 22nd and 31st percentiles, respectively.

Nutrien has a Growth Grade of A, which is very strong. The company has generated positive annual cash from operations in the past five consecutive years and has a five-year annualized sales growth rate of 5.3%.