AI for Financial Document Analysis: Your Net in a Sea of Information

Quickly processing news and reports with AI tools allows your finite attention to focus on interpretation and decision-making.

The average earnings report runs 30 pages. A typical earnings call transcript? 10,000 words. Add daily financial news, analyst notes and U.S. Securities and Exchange Commission (SEC) filings, and self-directed investors face an impossible task: processing more information than institutional investors—with a fraction of the time or support.

Now that we understand the challenge, let’s examine what makes artificial intelligence (AI) particularly suited to tackle this financial information overload.

The Document Overload Problem

Market-moving information bombards you from every direction: quarterly reports packed with deliberate obfuscation, earnings calls where executives dance around uncomfortable questions and analyst notes buried in jargon. Combined, this creates a brutal asymmetry for individual investors: Institutions employ teams to decode this information while you’re expected to do it alone in your spare time.

AI can change the game for you. Large language models (LLMs)—the application of AI most widely available to individuals—don’t just read text; they digest it. They can process documents in seconds that would take you hours to read. LLMs also extract patterns that aren’t always obvious when a document is first read. The benefit isn’t theoretical; it’s immediate and tangible.

The Technical Foundation

What makes LLMs so effective for financial document analysis? These models have been trained on a vast body of financial texts: annual reports, market analyses, economic papers and news articles. This training gives them a certain level of understanding of financial terminology, reporting structures and even the typical patterns of disclosure (and obfuscation) in corporate communications. When applied to earnings reports, LLMs can recognize standard accounting terminology while identifying unusual phrasing that might signal concerns.

Unlike simple keyword searches, LLMs understand the context and can distinguish between positive statements about past performance and cautious language about future prospects. This contextual understanding is critical when analyzing sentiment in financial documents where the most crucial information is often buried in subtle language choices.

With this understanding of how LLMs process financial texts, let’s explore specific ways you can put these capabilities to work immediately.

Practical Use Cases

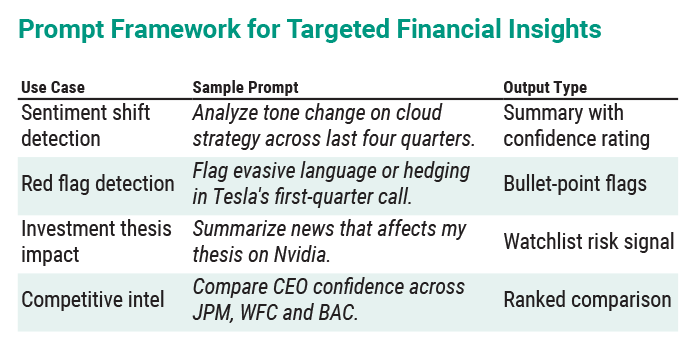

When reading dense research or earnings material, knowing what to ask an AI chatbot is key. The following prompts demonstrate how to direct AI toward different types of financial insights, from broad overviews to specific investment details.

For general overviews: “Summarize the main points of this Wall Street Journal article, highlighting the key market movers and analyst opinions.”

For investment-specific insights: “Extract from this Morgan Stanley report on Tesla: (1) price target, (2) growth drivers, (3) primary risks and (4) competitive positioning.”

For comparing multiple viewpoints: “Compare the bull and bear cases across these three analyst reports on Nvidia, focusing on points of consensus and disagreement.”

The Real World Example box below shows how it works with an actual earnings summary using AI.

AI News Summaries: Best Practices

Here are some suggestions for using AI to summarize news on stocks you follow or are interested in.

Target what matters to your strategy: Generic summaries waste your time. Direct the AI toward insights relevant to your investing approach.

Dictate the format: Your brain processes information in specific ways. Demand outputs that match how you think.

Provide your context: A value investor needs different highlights than a momentum trader. Tell the AI which lens you’re looking through.

Probe beneath the surface: Initial summaries often miss critical nuances, so dig deeper with targeted follow-ups.

Mastering Earnings Season

While daily news provides ongoing context, earnings season presents particularly concentrated information challenges that require specialized AI approaches.

Quickly Digest Earnings Releases

Basic summary prompt: “Break down Amazon’s fourth-quarter 2024 earnings release: (1) revenue growth vs. expectations, (2) profit margin trends, (3) segment performance and (4) guidance changes.”

Comparative analysis prompt: “Compare Microsoft’s third-quarter 2024 results against analyst expectations and highlight any meaningful departures from previous quarter patterns.”

Trend identification prompt: “Track Apple’s product segment performance across the last four quarters and flag any consistent patterns or concerning shifts.”

Mine Earnings Call Transcripts

The gold in earnings calls lies not in the scripted sections but in the subtle signals between the lines.

Management sentiment analysis prompt: “Analyze Microsoft’s earnings call for: (1) shifts in tone when discussing cloud growth, (2) hesitation patterns around hardware questions and (3) confidence markers when addressing competitive threats.”

Red flag detection prompt: “Flag moments in this Tesla earnings call where executives: (1) dodged direct questions, (2) used qualifying language or (3) contradicted previous guidance.”

Forward-looking statements prompt: “Extract Walmart’s forward-looking statements and classify each by: (1) confidence level, (2) specificity and (3) alignment with previous quarter projections.”

Personal Investment Briefing System

You can also use AI to create a high-level summary of news events or matters affecting your portfolio.

Morning market overview prompt: “Synthesize overnight market movements with specific impact assessments for my watchlist: AAPL, MSFT, AMZN, NVDA.”

Weekly earnings digest prompt: “Extract pattern-breaking results from technology sector earnings this week, prioritizing guidance shifts over backward-looking metrics.”

Monthly portfolio review prompt: “Analyze recent developments for my holdings [list stocks] and identify which position deserves immediate attention based on risk/reward shifts.”

Advanced Techniques

Once you are comfortable with basic approaches, you can start using these higher-value applications.

Comparative industry analysis prompt: “Map sentiment patterns across banking CEOs this quarter, ranking confidence levels about loan growth and identifying outlier perspectives.”

Pattern recognition across time prompt: “Track Netflix’s narrative evolution about content spending over the past eight quarters, noting linguistic shifts that preceded strategic changes.”

Custom scoring systems prompt: “Score these five tech earnings reports on: revenue growth (40%), margin expansion (30%) and forward guidance (30%), then rank them by investment potential.”

Putting It All Together: A Real-World Workflow

These individual approaches can be combined into a cohesive daily, weekly and seasonal research process.

1. Morning (15 minutes)

Feed market-moving news into your AI for personalized impact analysis

Flag developing stories that threaten your thesis on key positions

2. Earnings season (30 minutes per company)

Process the release for headline metrics and guidance shifts

Extract sentiment markers and evasion patterns from call transcripts

Compare language patterns with previous quarters to detect subtle changes

3. Weekend research (1–2 hours)

Process multiple analyst perspectives to identify consensus blind spots

Map contrarian viewpoints against your holdings

Generate specific questions that remain unanswered after AI analysis

Understand AI’s Limits

Though AI has very strong analytical power, it also comes with blind spots that every investor must recognize.

Knowledge boundaries: LLMs operate with training cutoffs. Verify time-sensitive information independently.

Convincing fabrications: AI occasionally invents plausible-sounding answers. Cross-check critical data points, especially numerical claims.

Contextual tone-deafness: Subtle communication elements—industry-specific understatements, cultural contexts and strategic ambiguity—can escape AI detection.

Missing vocal patterns: Human analysts pick up on vocal stress, unusual pauses or tone shifts that text analysis misses entirely.

Isolated analysis: AI doesn’t connect company-specific details to broader economic patterns unless explicitly prompted.

Measuring Your AI-Assisted Analysis Success

To evaluate the effectiveness of your AI-assisted process, monitor it with these metrics.

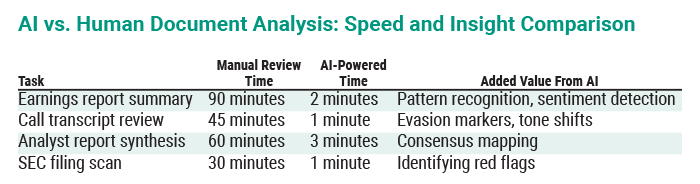

Time efficiency: Measure the time spent analyzing financial documents before and after implementing AI assistance. You may realize 60% to 80% in time savings.

Information coverage: Track the number of companies and documents you’re able to analyze. You may be able to expand your research universe by 3–5 times.

Decision quality: Record the specific insights that influenced your investment decisions and review them quarterly. Look for patterns in which types of AI-surfaced information led to profitable moves.

Miss rate: Periodically review significant market or stock moves and assess whether your AI system flagged the relevant information beforehand. This helps refine your prompting strategy.

Comparative returns: Compare the performance of positions where you leveraged AI analysis versus those where you didn’t. While many factors influence returns, patterns may emerge over time.

AI Tools Worth Exploring

While many AI tools can analyze financial documents, they vary in capabilities and cost.

General-Purpose LLMs

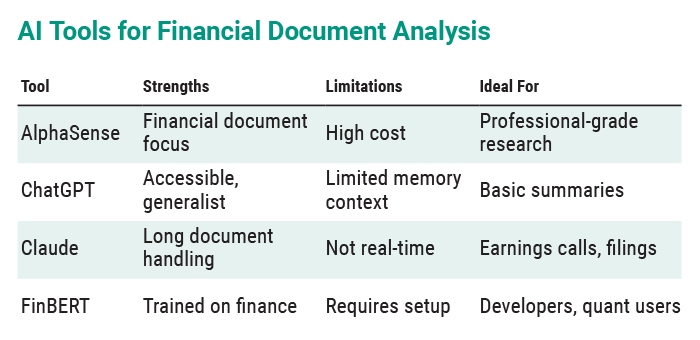

ChatGPT (OpenAI): A good starting point with free tier; a limited context window

Claude (Anthropic): Excels at processing longer documents; strong reasoning capabilities

Gemini (Google): Integrated with Google search; helpful for real-time data

Specialized Financial AI

AlphaSense: Purpose-built for financial document analysis with extensive financial data integration

Bloomberg Terminal AI: Powerful but expensive; best for professional investors

TipRanks: Offers AI-powered analysis of analyst reports and sentiment tracking

Developer-Focused Options

OpenAI API: Build custom applications with more control and larger context windows

FinBERT: Open-source model specifically trained on financial texts; requires technical expertise

LangChain: Framework for creating custom document processing workflows

Final Thoughts

AI amplifies your analytical capacity, but it doesn’t replace judgment. It processes what would overwhelm you, extracting signals from noise and allowing your finite attention to focus on interpretation and decision-making.

This technological edge helps close the gap between solo investors and institutional machines. The quality of insights depends entirely on how precisely you direct these tools. Refine your prompting techniques relentlessly, and what was once an overwhelming flood of information becomes your strategic advantage.