A One-Page Wealth-Building Plan for Managing the Costs of Late-in-Life Care

One of the biggest challenges in financial planning and investing is longevity risk. A one-page PRISM plan can help you prepare for the forthcoming costs.

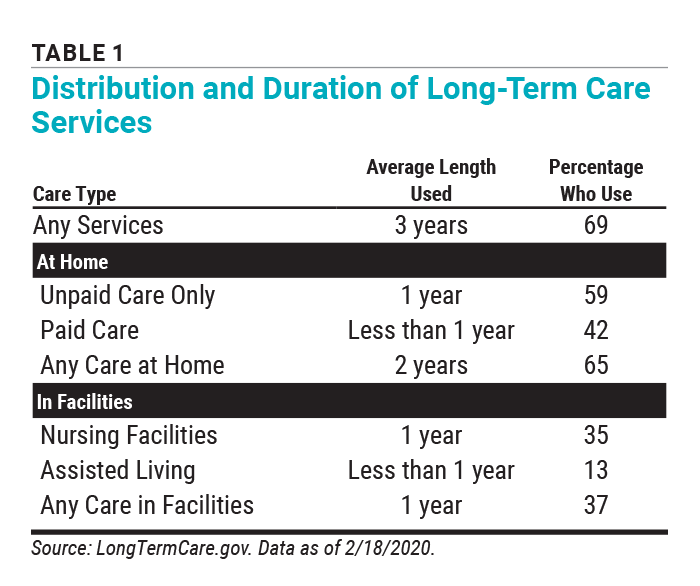

Late-in-life costs are difficult to predict but can be significant. LongTermCare.gov estimates that 69% of people will use long-term care services. The average duration of long-term care is three years (Table 1).

A large variance exists around these numbers. While one-third of those who are currently age 65 will not need significant long-term care, 20% w…